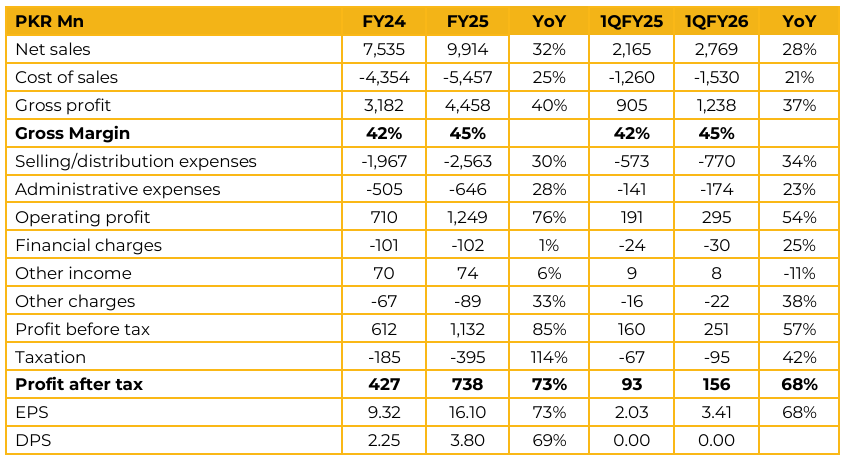

Macter International Limited recorded earnings per share of PKR 16.10 in FY25, as compared to earnings per share of PKR 9.32 in FY24. The company recorded net sales of PKR 9.9 Bn, up 32% from PKR 7.5 Bn in FY24. Along with this, it saw its gross margin expand from 42% in FY24 to 45% in FY25. As a result, gross profit surged 40% from PKR 3.2 Bn in FY24 to PKR 4.5 Bn in FY25. MACTER posted profit after tax of PKR 738 Mn in FY25, compared to profit after tax of PKR 427 Mn in FY24.

The management highlighted that according to IQVIA numbers, Macter has been growing its revenue at 1.5-1.7x the industry’s growth. It was highlighted that the company is one of two companies in Pakistan with Semaglutide available in pre-filled syringe and pre-filled multi-dose pen form. Moreover, there are only 4 companies with this product available in injectable format.

Therefore, in line with global trends the management expects substantial growth in revenues from this product as more doctors begin prescribing it. At this point in time, the biggest players in this segment are Novo Nordisk and Ferozesons with Macter and Getz holding the second largest shares. It is also expected that as the global patent for this product expires the company will begin export of the same to other markets.

Management was also hopeful that tirzepatide (a drug used for the same patients) will also be launched soon with the approval application for it already submitted to DRAP. Currently the company serves about 15 countries with its product portfolio and is working to expand its reach to 30 countries by the end of FY27.

With regards to questions regarding expansion, the management clarified that it owns 16 acres of land in Gadap and over the next 5 years expects to expand using the same space. MACTER has a subsidiary by the name of Misbah Cosmetics which is venturing into the cosmetics space.

It is pertinent to note here that one of the group’s companies also includes Depilex Beauty which is a network of over 80 salons across the country. It was highlighted that this network is used to test products, develop new products, gather consumer insights and help source new ideas.

This venture started as import-based model which has been switching to local manufacturing. The company has been leveraging its pharma experience to ensure high quality. This segment has been seeing improving gross margins and it is expected to begin contributing to the company’s bottom-line from this year. Moving forward, the management apprised that it expects the growth momentum of the first quarter to continue moving forward as new products gain traction.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.