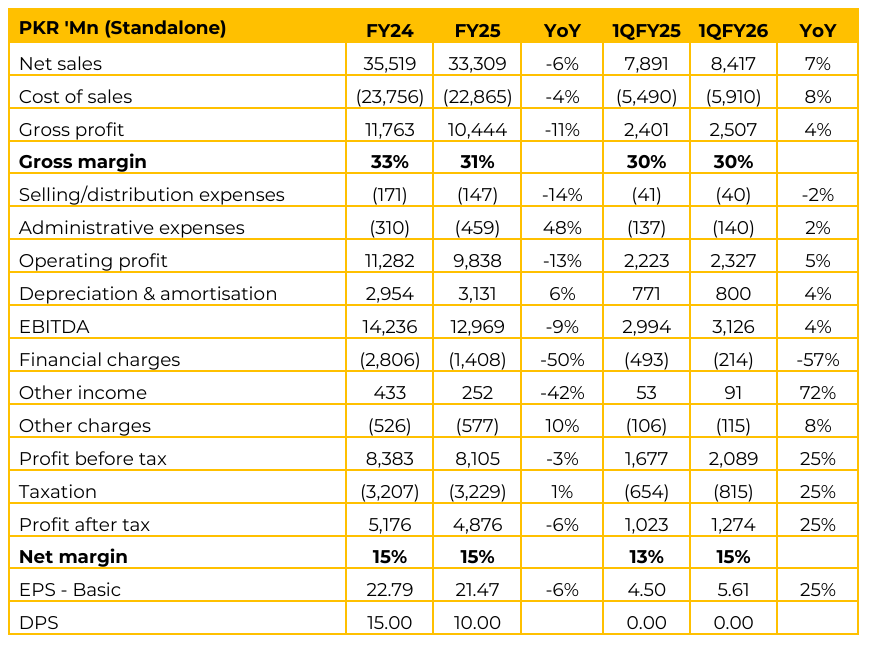

PIOC has reported standalone earnings per share of PKR 21.47 in FY25 (FY24: PKR 22.79). Furthermore, in 1QFY26 the company reported EPS of PKR 5.61 (1QFY25: PKR 4.50). Gross margins decline primarily due to higher royalty rates imposed by Punjab Govt. The company is booking provision based on 6% of ex-factory selling price of cement.

The management has mitigated this by significantly lowering fuel and power costs. The management noted that the case against royalty is scheduled for hearing in upcoming days, and is hopeful that the case will conclude in a level playing field for the cement manufacturers across the country.

The company is strategically shifting gears on volume, aiming for higher capacity utilization in FY26 after deliberately sacrificing dispatches in FY25 to focus on premium markets and retention. PIOC, currently debt-light with a near 1:1 gearing ratio, is considering capacity enhancement (BMR and potentially adding an efficient 2.5 million ton line) contingent on improving utilization, economic, and political stability.

Cement is heavily taxed, with almost 40% of a turnover going into various taxes. Management is hoping for corrective measures or policy rationalization from the government. The dividend was reduced to conserve funds required for Balancing, Modernization, and Replacement (BMR). Capacity utilization averaged 41% in FY25 (below the 50% industry average for medium-sized plants).

This deliberate low utilization was intended to maintain a good retention by targeting premium areas and ensure a high EBITDA. Management noted that while the industry was down 3-3.5% in FY25, PIOC was down 12%. The overall market has grown 18% in the first four months of FY26, and PIOC expects its overall volume sales to grow by 20% to 25%. PIOC uses only 5% grid power, with the remaining 95% derived from captive power. The total effective net captive capacity is about 33-34 MW (24 MW coal-based and 8 MW based on waste heat recovery).

In FY24, the fuel mix was 75% local coal and 25% imported coal. However, in FY25, the mix was 65% local coal, 5 % Afghan coal and 25% blended coal. In 1QFY26, the company primarily used 100% blended coal. Due to increasing local prices and supply constraints (switching from Afghanistan sourcing), PIOC is moving to imported RB2 Indonesian coal. RB shipments take about two months. RB coal is priced around $102 with a GCV of 6,200 kilojoules.

Last year, the average retention was over PKR 16,000+ per ton. Currently, it has come down by about PKR 750 per ton. Following recent price increases, management expects the current retention price to be around PKR 15,450 to PKR 15,500 per ton. Going forward, management’s future strategy is to become more efficient, and look at capacity enhancement if capacity utilization moves forward. The minimum annual capital expenditure required for maintenance (capex) is estimated to be approximately PKR 2 to PKR 2.5 billion.

New capacity would aim to utilize local Thar coal and explore future possibilities related to renewables like hydrogen. Management is hoping for double-digit growth for the full year, but anticipates 6% to 8% growth if the economic and political status quo remains locked by IMF program requirements. While export prices to Afghanistan are better than last year, the ongoing escalation of the situation suggests that the current fiscal year will be “slightly difficult and different” for this market.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.