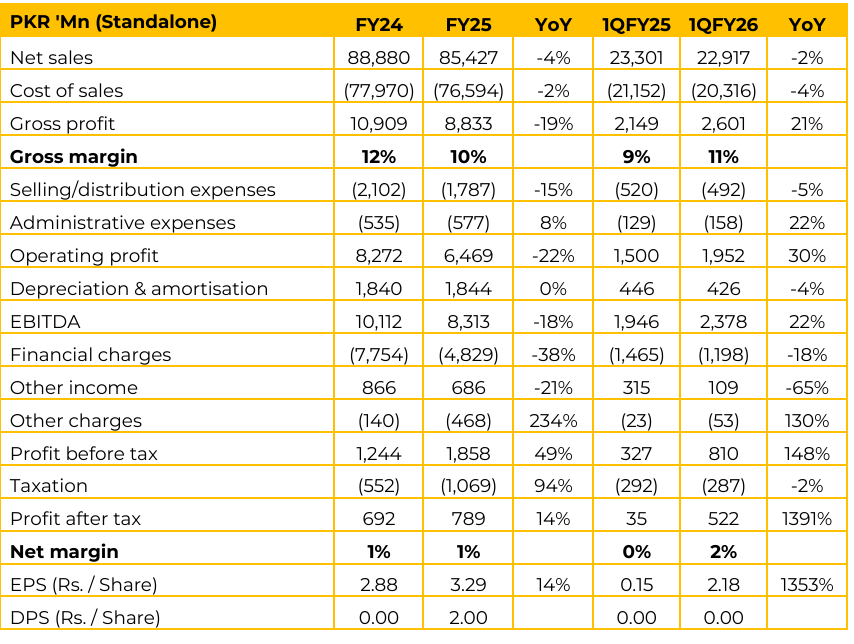

NCL has reported standalone earnings per share of PKR 3.29 in FY25 (FY24: PKR 2.88). Furthermore, in 1QFY26 the company reported EPS of PKR 2.18 (1QFY25: PKR 0.15). The company generated 63% of its sales from the domestic market and 37% from exports.

Spinning remained the leading revenue contributor with a 57% share, followed by Home Textile at 27% and weaving at 16%, while a minor portion was contributed by external power sales. Within the Spinning segment, overall sales declined mainly due to a sharp contraction in exports, as reduced yarn demand from China stemming from the ongoing China-US trade tensions significantly impacted performance. Export sales were nearly halved however, NCL was able to capitalize on stronger local demand to offset part of the impact. Sales in the Home Textile segment remained largely steady YoY, with the division continuing to rely heavily on exports.

For the current year, management is focused on maximizing the use of local cotton, targeting roughly 70% domestic sourcing. This strategic shift is driven by favorable pricing and lower mark-up costs, making local cotton more cost-effective and easier to finance.

The company’s total annual in-house power requirement is approximately 300 mn units. NCL uses a blended power generation model, relying on its captive 46 MW coal based plant, gas generators, and solar energy. Solar currently contributes around 20% of total power needs, mainly during the summer months. The average power cost ranges between PKR 28–32 per unit. The operational capacity of the coal plant stands near 40 MW, with any surplus power sold externally. Management highlighted that strong margins in 1QFY26 were primarily driven by recovery in the Spinning segment, while the Home Textile business remained stable.

The improved margins were supported by lower local cotton prices. Looking ahead, management maintains a positive outlook, expecting both Weaving and Spinning divisions to recover further particularly if international and local cotton prices strengthen. Demand from China and Bangladesh has reopened, with exports to both markets resuming momentum For the next year, NCL plans to undertake capex for establishing a new Open-End yarn production facility, which is expected to yield better margins. In the Weaving division, 22 new looms are being installed to enhance capacity.

The company’s sales target for FY26 is set at PKR 100 billion, though management continues to emphasize profitability over topline growth, prioritizing sales in high margin segments. Management also views the removal of the sales tax exemption on imported cotton and yarn under the Export Finance Scheme (EFS) as a positive policy development for both NCL and the broader domestic spinning industry. This move has strengthened local yarn demand and boosted demand for value added products.

Regarding its property business, management noted that the company holds land in Gulberg, Lahore, which remains on its books. Although development activities have yet to commence, the long-term plan is to channel this asset into a Real Estate Investment Trust (REIT) structure.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.