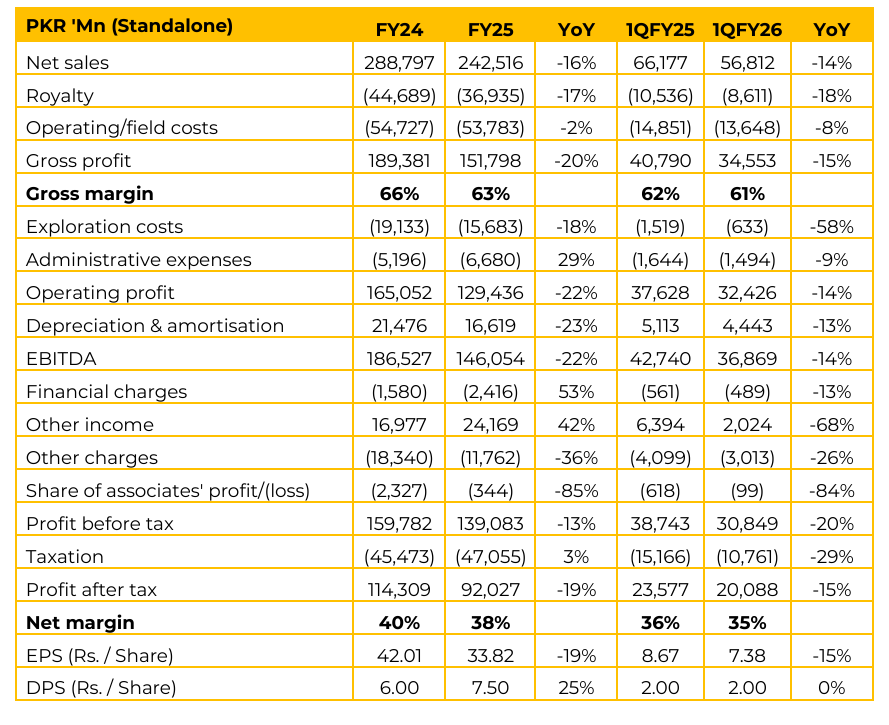

PPL has reported standalone earnings per share of PKR 33.82 in FY25 (FY24: PKR 42.01). Furthermore, in 1QFY26 the company reported EPS of PKR 7.38 (1QFY25: PKR 8.67). PPL reported eight discoveries during the year two operated and six partner operated.

The company’s customer collection ratio improved significantly, rising from 81% to 91%. PPL successfully completed the operating and financing agreements for the BLZ project. The feasibility study for the Reko Diq project has also been finalized, with financial closeout currently in progress. Production remained constrained mainly due to SNGPL curtailments and low offtake by GENCO II.

Although PPL and its joint ventures have a combined production potential exceeding 700 MMscfde. The Sui field continues to decline at roughly 7% annually, while Kandhkot’s decline rate stands around 13%. The recently drilled Dhok Sultan well is currently producing approximately 400 barrels per day, with potential to increase to between 1,000 and 1,400 barrels per day over time.

The company faced major gas curtailments from the Sui, Nashpa, and Tal blocks. Mitigation efforts include rerouting part of the gas supply to SSGC and exploring third-party sales arrangements. If RLNG cargo arrivals are deferred, it could create an opportunity for PPL to enhance its output up more than 50 MMscfde of production capacity.

The renewal of the Sui D&PL lease is expected to be finalized soon, likely within the next couple of months. For FY26, PPL plans to drill around 15 wells, the majority of which will be exploration wells, alongside four to five development wells. Drilling of the first Offshore block is planned for Q1 2027. Sui Gas Pricing is around $3 per mmbtu. There is no incremental pricing mechanism applicable.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.