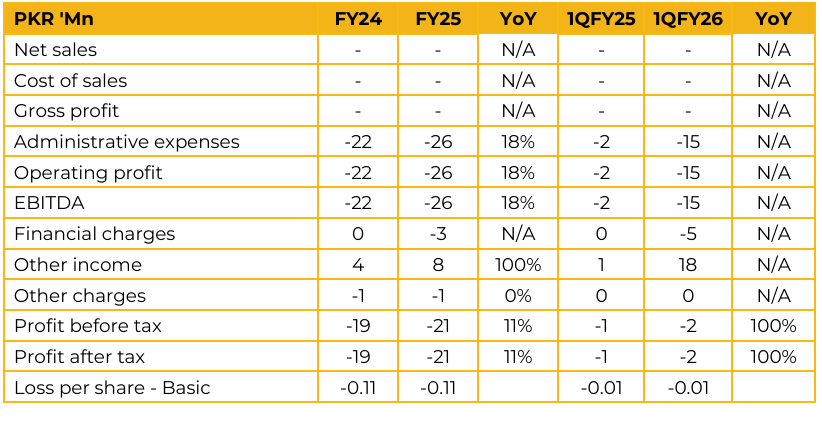

Mughal energy Limited (GEM) (GEMMEL) reported loss per share of PKR 0.11 for FY25, compared to PKR 0.11 in FY24. Furthermore, in 1QFY26, the company reported loss per share of PKR 0.01, compared to loss per share of PKR 0.01 in the same period last year (SPLY).

The project is a 36 MW Hybrid Captive Power Plant, designed to operate on a dual fuel that is utilization of coal (RB1, RB2, and potentially local coal) along with a 30% green fuel mix. All final construction and testing phases required for transmission connectivity are nearing completion.

The plant is expected to commence commercial operations and power generation by the end of this calendar year. Although the plant is engineered to utilize local coal, this fuel source presents critical quality variations that require careful testing to prevent system congestion and unplanned shutdowns. To ensure operational stability and sustained efficiency, the company plans to initially operate the plant on imported coal and biomass for the first six to eight months.

The gradual transition toward local coal, targeting a 10–20% reduction in imported coal usage, will depend on whether the cost advantage of local fuel offsets the potential maintenance expenses and efficiency losses associated with its lower quality. Based on current estimates, the energy cost using 100% imported coal is approximately PKR 22 per unit, with an additional capacity payment of around PKR 6 per unit, bringing the total cost to roughly PKR 25–27 per unit.

This remains significantly lower than the current grid tariff of PKR 37–38 per unit. The plant’s average efficiency is expected to be around 35%. The plant’s gross generation capacity stands at 36.5 MW, with the produced energy to be primarily consumed by the parent company’s steel plant. Management is currently in discussions with banks to secure working capital financing, which is expected to be finalized by the end of December.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.