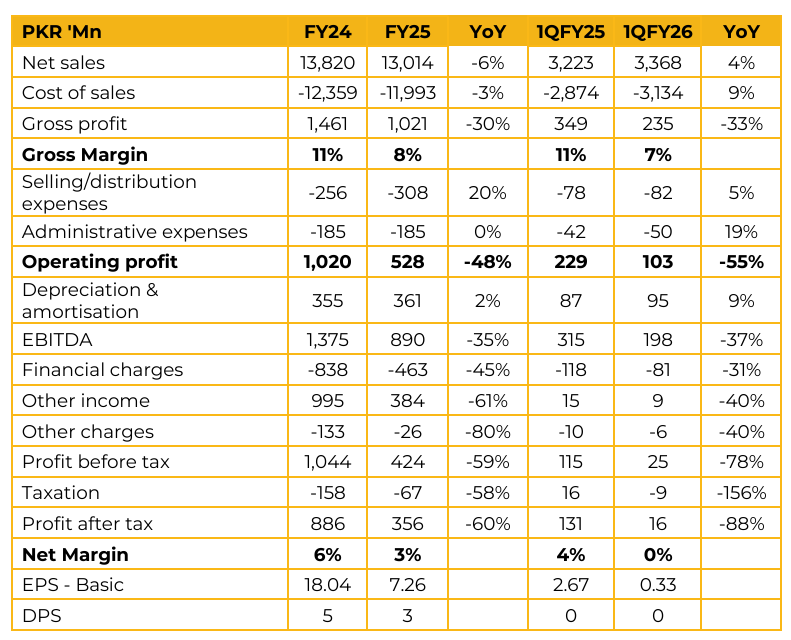

Cherat Packaging Limited (CPPL) reported earnings per share of PKR 7.26 for FY25, compared to PKR 18.04 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 0.33, compared to earnings per share of PKR 2.67 in the same period last year (SPLY).

The Bags Manufacturing Division reported a loss of PKR 75 million in Q4 FY25, primarily due to reduced customer purchases as clients sought to limit inventory levels, along with the low sales in recently launched SOS Division. Management, however, noted that demand is already showing signs of recovery.

A significant variance was noted in other expenses and other income, mainly attributed to the sale of large craft paper line machines in the previous year, which generated a higher one-time gain on disposal. During the year, CPPL sold its remaining two craft paper lines, a timely strategic move that enabled the company to retire debt when interest rates were near their peak (around 22%).

The paper division had previously contributed a substantial portion of total revenue. The company also faced headwinds from a slowdown in cement dispatches across Pakistan, leading to intensified competition in the polypropylene (PP) bag segment, compounded by new market entrants. Nearly the entire cement industry has shifted its demand from paper sacks to PP bags, impacting traditional sales volumes.

To mitigate pressure from the cement sector, CPPL has significantly increased its focus on non-cement bag markets, targeting industries such as sugar, flour, dairy feed, chemical, and fertilizer. As a result, non-cement bag sales have grown manifold compared to the previous year.

The company has ordered a second extrusion line, specifically a barrier line, to expand its production capabilities. While overall Flexible packaging division capacity utilization stands at 60%, the existing non-barrier extrusion plant is running at full capacity (100%).

The new barrier extrusion plant is critical, as it will meet existing market demand and enable entry into new product categories, such as oil and liquid packaging. This addition will help eliminate production bottlenecks and support future growth.

Additionally, an extra 2.7 MW of solar panels is being installed at the factory to reduce energy costs, bringing the total solar generation capacity to approximately 3.7 MW.

The company aims to meet 45–50% of its power requirements through solar and hydel sources. Management views the macroeconomic environment as more favorable compared to last year, citing declining discount rates and currency stability, and expects to benefit from these improving conditions in the coming periods.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.