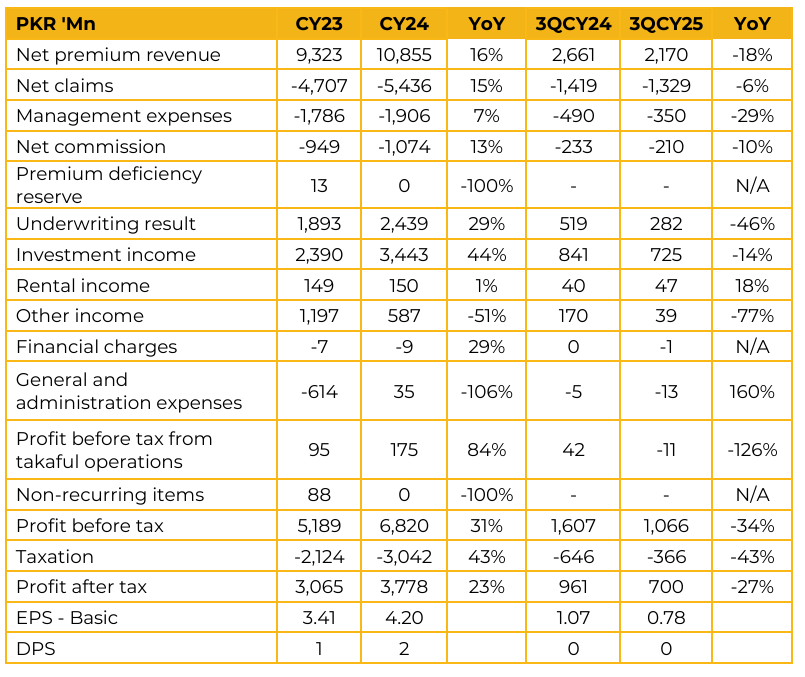

Pakistan Reinsurance Company Limited (PAKRI) reported earnings per share of PKR 4.20 for CY24, compared to PKR 3.41 in CY23. Furthermore, in 3QCY25, the company reported earnings per share of PKR 0.78, compared to earnings per share of PKR 1.07 in the same period last year (SPLY).

PRCL provides reinsurance solutions across multiple segments, including Aviation, Marine, Engineering, Fire, and Accident. The company’s long-term vision is to position itself as the premier provider of reinsurance and risk management services in the region.

The average return on fixed income securities currently stands between 12.5% and 13%. Management noted that these yields are still higher than KIBOR however, returns are expected to soften as short-term investments booked at elevated rates last year mature and are reinvested at lower prevailing yields. Local retention typically averages 35–40% but can rise to 40–43% in certain periods.

However, in quarters that include high value public sector accounts (e.g., PIA bookings), retention levels can decline considerably due to the size of these exposures. Management expects steady business growth over the next three to five years, driven by increased activity in public sector projects and mining related projects. PRCL confirmed that it remains on the active privatisation list, though no specific timeline can be given.

Regarding taxation, management highlighted that the 2012 law taxed both insurance and reinsurance activities. The company received SRB notices in 2017 and subsequently paid PKR 2.5 billion. PRCL clarified that reinsurance is not a separate taxable business and has challenged the notice in the Sindh High Court. SRB has tentatively agreed to waive prior liabilities and allow adjustment of the PKR 2.5 billion already paid, conditional on PRCL commencing sales tax invoicing going forward. Discussions remain ongoing, regarding legal hurdles related to this potential settlement

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.