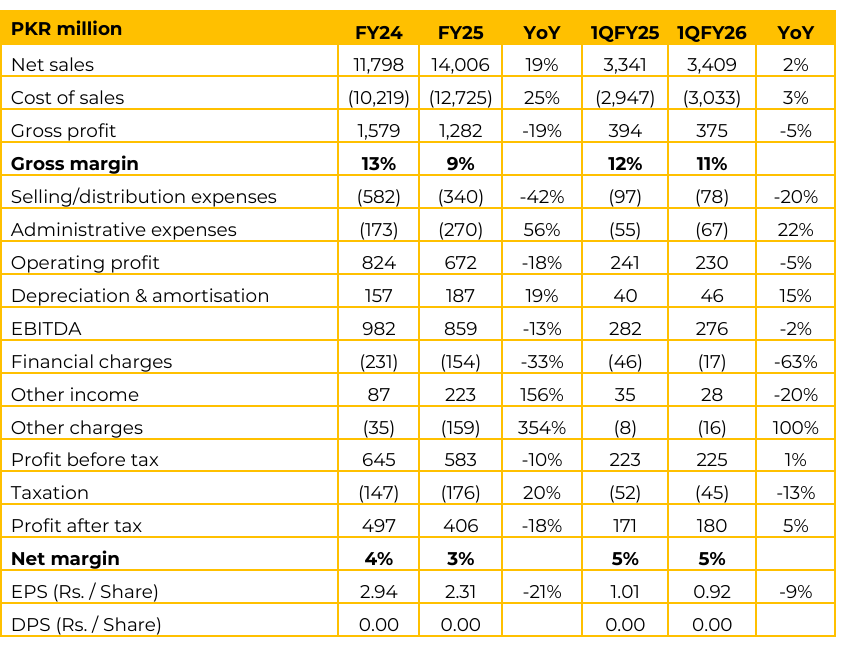

TOMCL has reported earnings per share of PKR 2.31 in FY25 (FY24: PKR 2.94). Furthermore, in 1QFY26 the company reported EPS of PKR 0.92 (1QFY25: PKR 1.01). The net profit margin has fallen predominantly because of the change in taxation. The effective tax rate has increased significantly. Previously, under final fixed tax regime, where income tax was pegged at 1% on export turnover/proceeds.

The effective tax rate was previously around 18.5% to 20%. Currently, there is Normal Tax Regime (29%), plus Super Tax, plus Minimum Tax (1%), plus an additional 1% adjustable advanced tax. The effective tax rate has jumped to approximately 39% or 43% when including non-recoverable indirect taxes.

The company is currently running pilot projects on breeding and goat farming. The company has acquired an additional 2.5 acres for fattening expansion. The company has undertaken a substantial expansion of its existing meat, chilling, and freezing capacities. TOMCL is in the process of building a processing facility for heat treated cooked offal at the Gaddap plant. Korangi plant houses an offal processing facility and Nally dehydrated pet chew processing. Product portfolio includes fresh chilled meat, frozen meat, vacuum packed meat,

Modified Atmosphere Packed (MAP) chilled meat, heat treated/cooked meat, private labeling, fresh/frozen salted white offal, fresh/frozen red offal, and dehydrated baked natural pet chews. Market coverage reaches across the Middle East, South Asia, Far East, CIS, North America, and European Union (for beef casings).

Tajikistan is a new addition. Revenue by product-line in FY25 entails beef exports (88%) and offals (10%), with mutton at 2%. The company considers itself predominantly a beef and offal exporting company. Export volume in FY25 included Vacuum packed meat (53%), Frozen meat (17%), Frozen offal (15%), Cooked meat (13%), Chilled meat (12%).

Currently, 100% of the animals are purchased from mundi (market). The company buys semi-finished animals and finishes them through its in-house fattening process, typically 3 to 6 months. Average utilization is estimated at 65% to 70%. Utilization fluctuates depending on shipping line schedules, running at 100% capacity for approximately three days a week and 50% for the remainder.

Capacity constraints are more related to chilled and frozen storage capabilities than slaughtering ability. The company has reduced its debt footprint by more than 60% since last year. Total debt footprint decreased from PKR 1.1 billion in 2023 to around PKR 500 million in 2025. The management expects to be a leverage-free company by 2027 or 2028. TOMCL has secured a USD 7.5 million export order from China for FY26, which is currently in the process of executing. The company has earlier negotiated an export contract for USD 8.1 million with Gold Crest Trading UAE.

Going forward, the management is focusing on vertical integration, margin improvement, and market diversification. The company is working with the government to create FMD free (Foot and Mouth Disease – free) compartment. Expanding product offerings in the pet chews business, which is expected to become a significant component of volume and value creation in the next two to three years. TOMCL is targeting new markets (China, Saudi, CIS) and expanding into private labeling. The company is actively working to reduce reliance on unsecured clean credit-based Gulf markets.

The company target revenue growth of 10% for FY26. Management noted that in Gaddap plant the grid electricity supply is merely for two hours. Hence, in the ongoing fiscal year, the company is working to solarize the Gaddap facility along with the battery solution for backup power.

Plans are underway for a 1.5 to 1.8 MW solar generation, at the Gaddap plant, aiming for 10% to 20% savings in power energy costs. The plant currently run 98% on Diesel based generators. The Korangi plant is 70% solar, 20% grid, and 10% diesel. New projects include dung palletization (for fuel efficiency), beef tallow manufacturing, a beef white offal cooking/heat treatment unit for China, and an enhanced red offal beef processing line for the UAE.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.