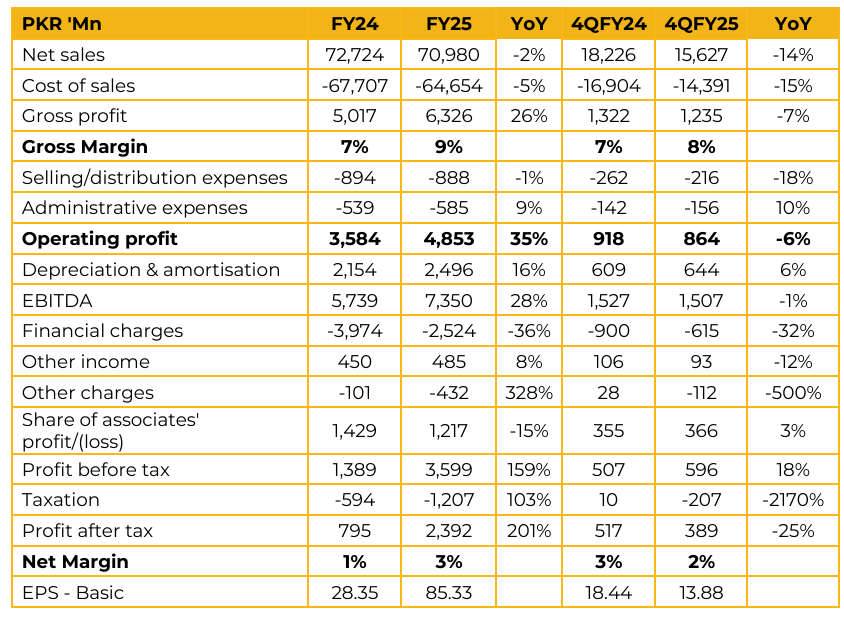

Gadoon Textile Mills Limited (GADT) reported earnings per share of PKR 85.33 for FY25, compared to PKR 28.35 in FY24. Furthermore, in 4QFY25, the company reported earnings per share of PKR 13.88, compared to earnings per share of PKR 18.44 in the same period last year (SPLY). In the near term, management does not anticipate significant export demand, primarily due to inconsistent policy implementation.

Company is replacing older energy-intensive machinery with more efficient equipment to enhance productivity and reduce operating costs. Furthermore, the Company aims to achieve 40 45% contribution from green energy in its total power mix by March 2026.

The reduction in U.S. tariffs on textile imports from 29% to 19%, coupled with the increase in export tariffs imposed on competing regional countries, has strengthened Pakistan’s competitiveness in global textile markets. In parallel, the removal of zero-rating on yarn imports under the Export Finance Scheme (EFS) is expected to further restore balance and enhance competitiveness within the domestic spinning industry, enabling local manufacturers to capitalize on improved export dynamics.

Following the EFS policy deferral from January, customers began building inventory in advance, leading to a slowdown in demand and higher stock levels. To manage this, the Company undertook aggressive sales, which temporarily weighed on margins. Going forward management expects strong performance from the dyeing and knitting segments, while spinning operations are likely to remain challenging in the near term.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.