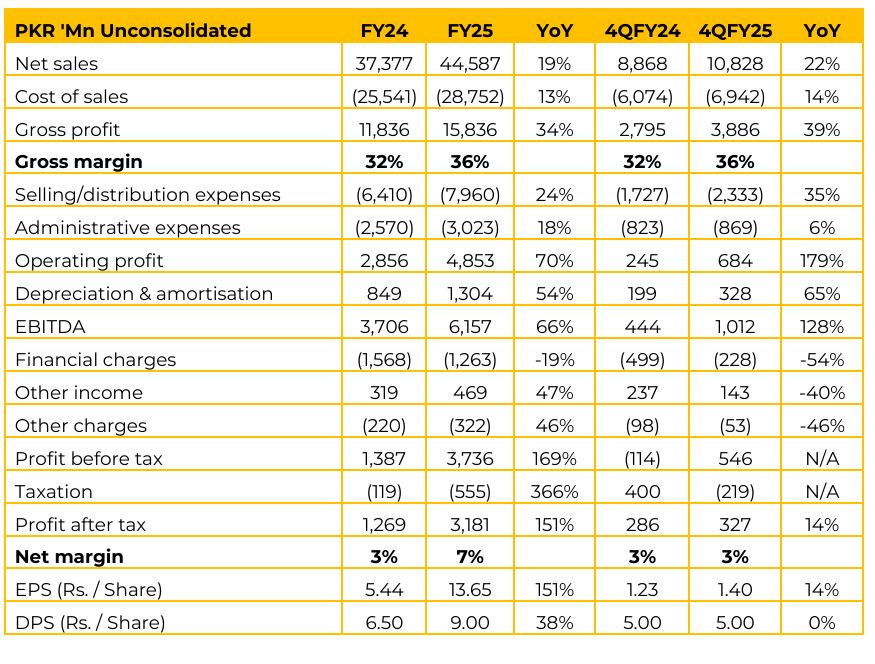

National Foods Limited (NATF) reported earnings per share of PKR 13.65 for FY25 (FY24: 5.44). Furthermore, in 4QFY25, the company reported earnings per share of PKR 1.40 (4QFY24: 1.23). Gross margins improved in 1QFY26 to 38% from average of 36% in FY25 primarily due to pricing factor and cost efficiencies associated with the Faisalabad plant.

Management is confident that this margin is sustainable for the rest of FY26. In the overall portfolio mix, the Faisalabad plant contributes around 70%. While Karachi plant caters the southern part of the country and exports. A critical distribution hub has been set in Canada to serve customers and improve speed to the market.

The company manages risk through a diversified product portfolio, under which they have launched the Drizzle sauces category, targeting the newer generation and a growing market In terms of revenue contribution, ketchup and pickles contribute around 10-15%, while recipe mixes contribute around 50-65%.

The unique Crush Pickle range has been extended internationally with different variants following fantastic performance. Direct imported raw material is around 15%. This percentage goes higher if indirect imports (spices not locally available, excluding red chili and kassuri methi) are included.

The company initiated a “seed to table project” to substitute a part of the tomato paste quantity, promoting sustainability and import substitution. Current tomato paste sourcing is approximately 30% to 40% local and the rest is imported, maintaining a balanced supply chain due to the crop-based nature of the product.

Management does not anticipate a major cost implication from recent floods due to risk coverage through international sourcing (red chili) and locked-in contractual costs via the seed-to-table project (tomato paste). International Division achieved +26% Revenue growth in FY25, with improvements in margins. Revenue crossed the $20 million mark for the first time. NATF has 50%+ revenue generated from international markets.

The export business is currently operating at a loss due to a strategy deployed two years ago involving heavy investment in growth, structural changes, and distributor transformations. Margin accretion is underway: 400 basis points improvement last year, 200–300 basis points improvement in Q1 this year, with a hope for a further 100 to 200 basis points improvement by year end.

The division is expected to break even and start delivering profit in the next two to three years. A-1 grew from a $50 million business in 2017 to approximately $300 million in FY25 (a six-fold increase). Revenue growth in FY25 was +18%. Operating profitability reached $23 million. NATF divested 50.5% of its shareholding and is retaining 9.5%.

Management believes the retained 9.5% shareholding should generate a similar value over a 10-year horizon as the current sale proceeds. Proceeds from divestment are currently in an escrow account in Canada. Disclosure and reflection in the financials (as a discontinued operation, already disclosed in 1QFY26) is expected by the 1HFY26 results. The cash will not sit idle and will be placed in short-term investments to generate income. Going forward, the management focuses on portfolio premiumization & innovation.

This involves leveraging brand equity and launching premium sub lines targeting urban millennials. Import substitution of ingredients and packaging is also on cards for cost optimization. International strategy involves penetration in ethnic markets and into mainstream outlets to reach customers beyond the ethnic segment.

The company is also planning a capacity expansion with a decent level of capital expenditure. Details were not disclosed. The management has modified the dividend policy to be more consistent with quarterly payouts with historical payouts being the baseline.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.