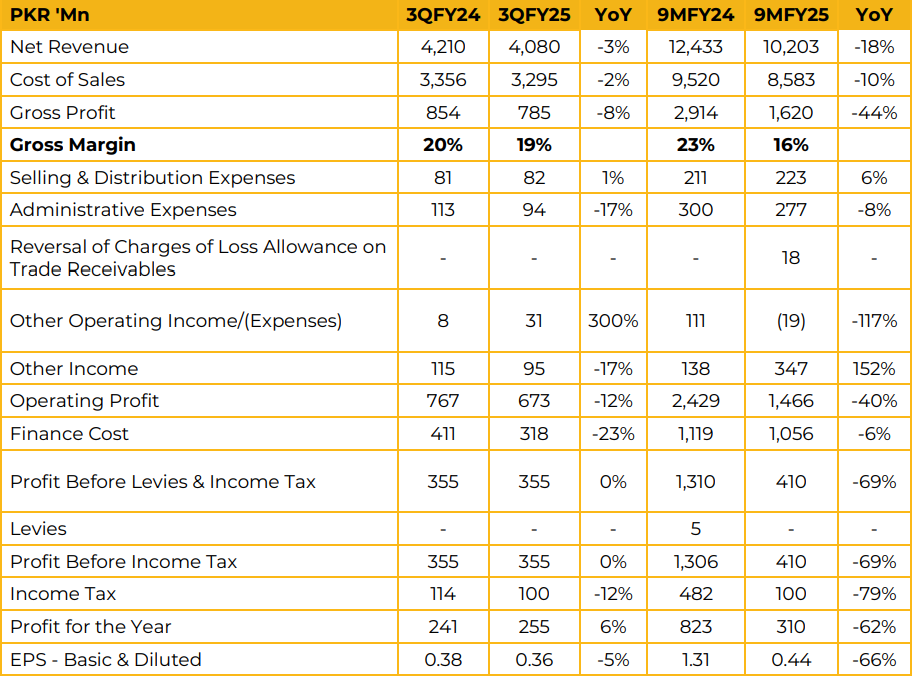

IPAK reported a net profit of PKR 309.89 million (EPS: PKR 0.44) in 9MFY25, down 62% YoY from PKR 823.38 million (EPS: PKR 1.31) in 9MFY24. The decline in profitability was despite strong topline growth, primarily due to elevated costs and a shift in product mix.

Consolidated revenue increased by 66% YoY to PKR 26.06 billion, driven by the commissioning of new production capacities. EBITDA rose by 12% YoY to PKR 3.57 billion during the same period.

However, total debt rose to PKR 28.0 billion, reflecting higher working capital requirements. Management reported that PKR 6 billion of revenue was generated through exports, while PKR 20 billion came from local sales On a standalone basis, revenue declined by 18% YoY in 9MFY25. This was attributed to a strategic shift in volumes towards global packaging. The company is focused on exports which offers thin but scalable margins.

Although the export market is saturated, management remains optimistic, citing significant long-term potential. Expansion plans include entering the Middle East export market and establishing offices in Europe and Africa to broaden international presence. Currently, 62% of total sales are made to the food industry. IPAK has installed 6MW of solar capacity, with an additional 1MW off-grid solar plant under trial.

The company primarily relies on RLNG to meet its energy needs, though it has contingency plans to switch to grid power in case of any levies on RLNG. In terms of trade policy, duties on BOPET have been reduced by 1%, and duties on polypropylene (PP) have dropped to 0% from 3%.

Additionally, finished product duties were also cut by 1% in the latest federal budget. The company maintains a dividend policy of distributing 33% of net income, subject to board approval. Management also highlighted that new entrants are expected in the polypropylene market, with additional production lines anticipated to become operational by June 2026.

During 9MFY25, capacity utilization stood at 67% for BOPP, 90% for CPP, and 46% for BOPET, bringing the overall utilization to 62%. Outlook: Management remains focused on expanding into high-margin export markets, particularly in specialized packaging films.

The company aims to drive innovation through advanced technologies, maximize cost efficiencies, and strengthen financial resilience. Going forward, BOPP and BOPET markets are expected to grow steadily at 6–7% annually, with margins likely to improve on the back of lower working capital requirements

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.