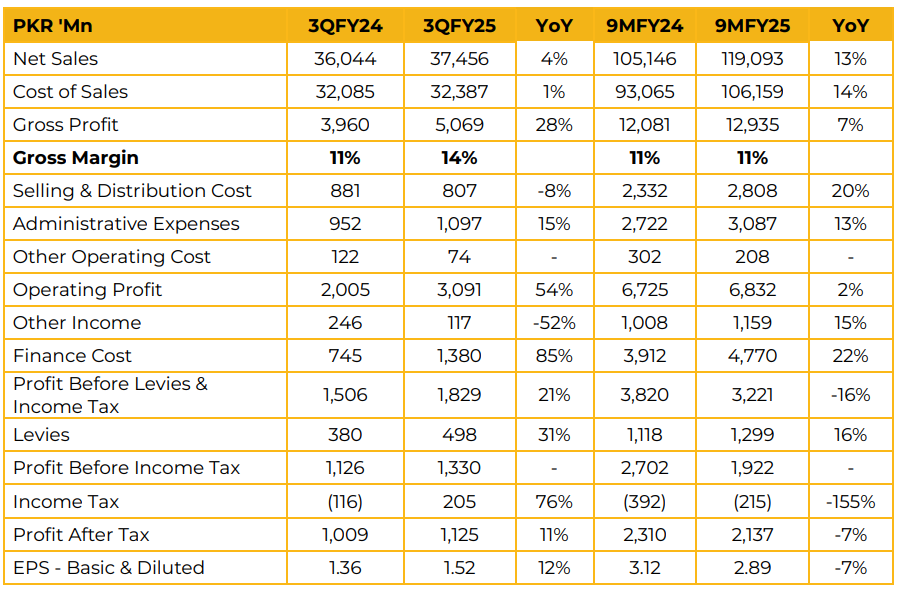

Gul Ahmed Textile Mills reported a net profit of PKR 2.14 billion (EPS: PKR 2.89) in 9MFY25, down 7% YoY compared to PKR 2.31 billion (EPS: PKR 3.12) in 9MFY24. The decline in profitability was primarily due to shrinking gross margins, impacted by the increase in minimum wages and elevated energy costs. Sales revenue for the period stood at PKR 119.09 billion. \

Regional performance showed YoY sales growth of 15.5% in Europe, 15.4% in Africa, 11.3% in Pakistan, and 3.6% in the Middle East. On the other hand, sales declined by 6.1% in the UK, 3.9% in North America, 21.5% in South America, 57.3% in Oceania, and 7.9% in Asia.

By business segment, sales during 9MFY25 included PKR 34.37 billion from the Spinning segment, PKR 83.23 billion from Home Textiles, PKR 4.77 billion from Weaving, PKR 1.59 billion from Knitting, and PKR 3.86 billion from Fiber Bleaching. Export apparel sales declined to PKR 10.35 billion during the period. The company expects export sales to reach USD 385 million in FY25, reflecting a 7-year CAGR of 8.04%.

The export sales mix comprises 85.12% made-ups, 9.24% apparel, 4.42% bleached fiber, 1.04% fabric, 0.39% dyed yarn, 0.25% dyed yarn fabric, 0.53% greige fabric, and 0.01% from other categories. Regarding energy infrastructure, GATM’s installed capacity comprises 30% gas generation, 25% reliance on K-Electric, 9% tri-fuel, 9% diesel, 7% HFO generators, 2% steam generators, and 2% solar.

The running load currently consists of 61% gas generation and 38% tri-fuel generation. Total power requirement stands at 40MW, with 60% of the energy mix currently sourced from HFO. The impact of the HFO levy is estimated at 60–65%. Management plans to transition 30– 35% of the energy mix to renewables over the next year. GATM has already completed a 1.42MW solar project. Additional projects in the pipeline include 17.3MW of solar by July 2025, 1.5MW by December 2025, and 5MW of wind power by December 2025. Battery energy storage projects (BESS) include 6.8MW by September 2025, 8MW by October 2025, and 5MW by April 2026.

The 15MW Solar IV and Wind II projects are expected to come online by April 2026, while a 20MW biomass cogeneration facility (with 30 TPH steam) is expected by December 2027. Yarn margins remain in single digits, largely due to elevated energy costs. GATM imports nearly 80% of its cotton, mostly from Brazil, to ensure consistent quality.

Going forward, the company expects spinning segment profitability to recover, driven by a healthy order book and the introduction of new value-added items. GATM aims to become fully reliant on renewable energy sources by 2030, with an intermediate target of sourcing 50% of its energy needs from solar and wind and the remaining from biomass. Export to North America is expected to remain dependent on evolving trade policy.

The company anticipates export sales growth of 7–8% in the next fiscal year. Return to shareholders is expected within the next 12–14 months. Regarding the IPO of its retail brand IDEAS, management noted that the company is focused on reducing debt and repositioning itself strategically. It has also stockpiled HFO to cover energy requirements for several months, resulting in increased borrowing during the period

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.