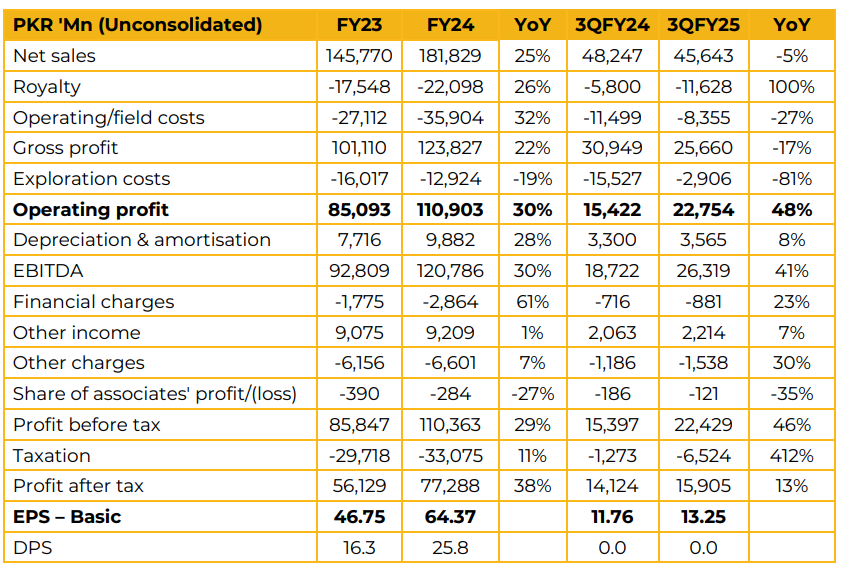

Mari Energies Limited (MARI) reported earnings per share of PKR 64.37 for CY24, compared to PKR 46.75 in CY23. Furthermore, in 1QCY25, the company reported EPS of PKR 13.25, compared to PKR 11.76 in the same period last year (SPLY). As of June 30 2024, MARI’s total reserves and resources stood at 816 mn barrels of oil equivalent (BOE), positioning it as the holder of the second-largest reserve base in Pakistan.

In the latest government bid round, MARI secured 10 out of the 13 exploration blocks it bid for seven as operator and three as nonoperator demonstrating its strategic positioning and technical strength in upstream development. A recent joint venture discovery, operated by PPL in which MARI holds a 32% stake, was swiftly connected to Mari’s Sujawal plant within two months of approval underscoring operational agility and strong collaboration.

The Shiva Complex commenced production on March 23, 2025, with the first condensate tanker dispatched by March 29. The facility is expected to deliver approximately 70 mmscfd of gas and 700 barrels per day of condensate at peak output. One of the key challenges that company faces is the increasing LNG inflow into the national grid, which constrains pipeline capacity and displaces indigenous gas production. This has adversely impacted revenue, production targets, and profitability. In field development, the Shawal-1 well is currently producing approximately 15 mmcfd of gas.

The follow-up Shaval-2 well has confirmed the presence of recoverable hydrocarbons, with an appraisal program underway to scale production up to around 30 mmcfd. The Spinwam discovery marked a breakthrough, with significant flows encountered across four formations (Samanasuk, Kawagarh, Hangu, and Lockhart) demonstrating outstanding flow rates.

The Key priorities include appraising and developing the Shewa field and progressing Shahbandar Phase 2. these initiatives are expected to collectively contribute an additional 25–30 mmcfd of gas. Regarding cloud they mentioned that first data center is planned for Capital Smart City, Islamabad, and the second for Port Qasim, Karachi. Each data center will be 5 megawatts, scalable to 10 megawatts. The target for the first data center to be online is within 2025

Going forward, the company is actively monitoring the progress of offshore Block 5 and is in the process of fulfilling regulatory requirements for the 10 newly provisionally awarded blocks. Additionally, MARI remains confident in its ability to ensure a sustained gas supply to the fertilizer sector, thereby supporting Pakistan’s national food security objectives.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.