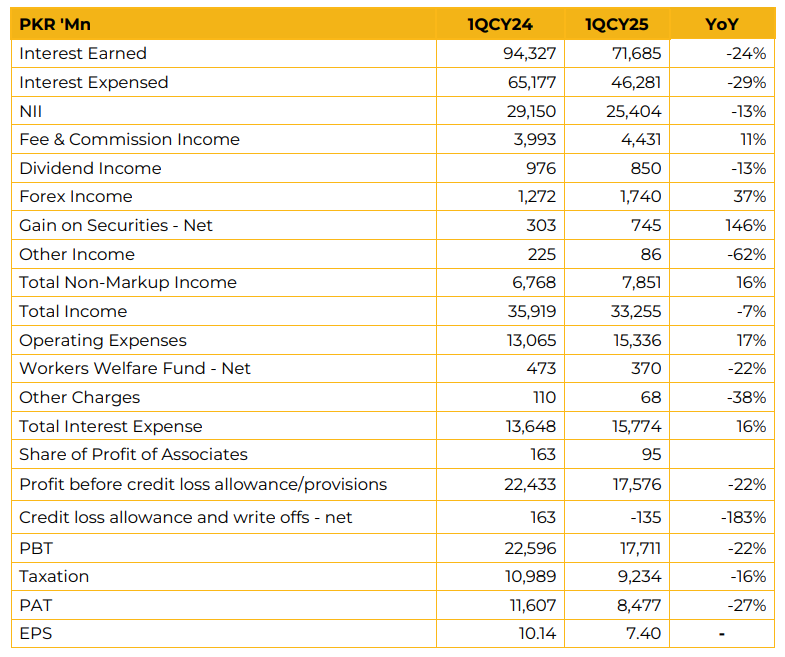

In 1QCY25, Allied Bank Limited (ABL) reported a net profit of PKR 8.45 billion (EPS: PKR 7.40), marking a 27% YoY decline from PKR 11.61 billion (EPS: PKR 10.14) in the SPLY. Total assets stood at PKR 2,738 billion as of March 31, 2025, reflecting a 3% YoY decline. Cash, bank balances, and lending to financial institutions fell by 59% YoY to PKR 164 billion, significantly sharper than the industry-wide decline of 8%.

Meanwhile, investments rose by 32% YoY to PKR 1,496 billion, outpacing the industry growth of 11%, primarily driven by higher exposure to Treasury Bills, Sukuk Bonds, and PIBs. Gross advances declined by 23% YoY to PKR 812 billion, versus a 17% drop in the broader industry.

ABL realized a capital gain of PKR 745 million in 1QCY25, up 146% YoY, supported by gains on Eurobonds and Federal Government securities. Deposits grew modestly by 2% YoY to PKR 2,052 billion, underperforming the industry’s 4% growth. The CASA ratio stood at a healthy 85% in 1QCY25. ABL’s gross ADR was 40.34%, remaining below the industry average. The deposit mix comprised 38% current, 48% savings, and 14% term deposits, with ABL maintaining a 6% share of the deposit market. NPLs stood at PKR 13.3 billion, reflecting a 2% YoY increase.

The NPL ratio was reported at 1.60%, with specific coverage at 93.5% and overall coverage at 115.08%. Key lending exposures included non-financial public sector enterprises, NBFIs, government, textiles, information & communication, food & beverages, and non-metallic minerals.

The investment portfolio as of March 2025 was primarily composed of 76% PIBs, 15% T-Bills, 1% equities (listed/unlisted), and 8% in TFCs, bonds, Sukuks, and mutual funds. PIB holdings included PKR 895 billion in floating-rate and PKR 252 billion in fixed-rate instruments, with a 3–5 year maturity profile.

Investments in PIBs rose by 37%, while T-Bill investments grew by 55%. Investments in equities increased by 1%, whereas exposure to fixedincome securities like Sukuks and TFCs declined by 8%. Yields on fixed PIBs averaged around 12%, while floating PIBs yielded approximately 14%. T-Bill yields remained above the policy rate. ABL recorded a capital gain of PKR 2.4 billion under other comprehensive income.

The bank also noted an improved dividend payout for the quarter. Management reported no material impact from the revision in MDR, and most asset repricing has already been executed. The bank remains focused on digital expansion and other growth avenues.

Operating expenses remain under pressure due to elevated marketing spend amid competitive dynamics, although the pressure is lower than the previous inflation rate. The bank operates 1,331 branches across Pakistan, including 161 Islamic and 18 digital branches. Looking ahead, ABL targets growth in low-cost deposits, especially current accounts, which are expected to rise by 14–15%, with a focus on retaining sticky deposits.

Management anticipates provision reversals to continue through CY25 and intends to proceed cautiously with balance sheet expansion, considering the current highinterest rate environment. While no rate cut is expected in the upcoming monetary policy, management anticipates a potential rate reduction of 1–1.5% over the end of CY25. A more substantial cut to 10% would shift the bank’s lending focus toward SMEs and consumer segments. Management does not foresee any new tax measures in the upcoming budget. The cost-to-income ratio is expected to remain at similar levels as this quarter

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.