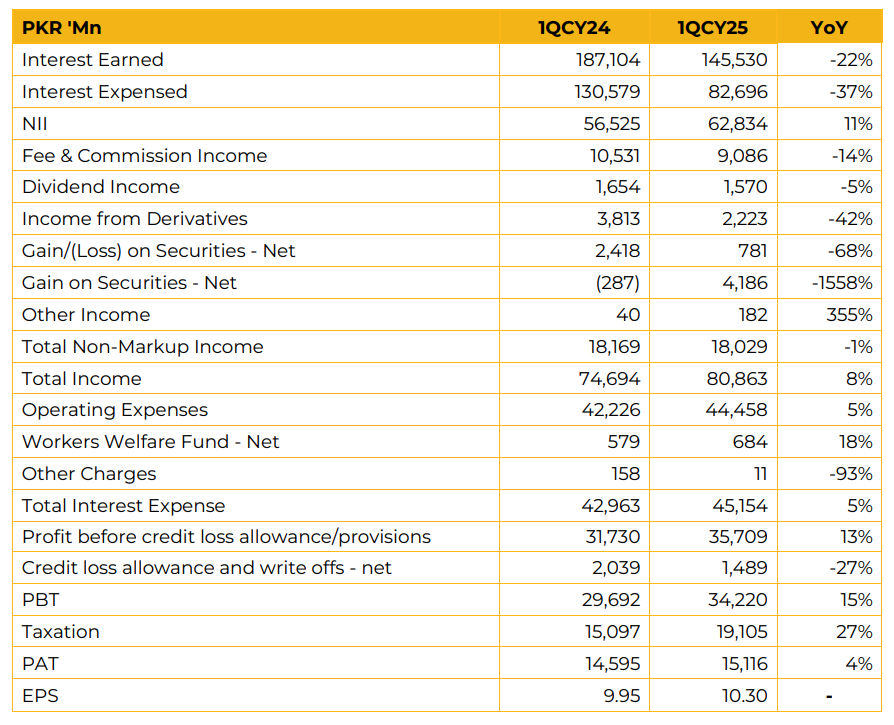

In 1QCY25, HBL reported an unconsolidated profit of PKR 15.12 billion (EPS: PKR 10.30), reflecting a 4% YoY increase compared to PKR 14.59 billion (EPS: PKR 9.95) in the same period last year. Total income increased by 8% YoY to PKR 80.86 billion, supported by strong growth in both net interest income (NII) and non-markup income.

Consolidated NII rose by 14% YoY to PKR 58.10 billion, attributed to a PKR 454 billion expansion in the average balance sheet. Non-markup income grew by 17% YoY to PKR 17.6 billion, primarily led by card-related fees—contributing over half of the segment—and gains on fixed income and treasury operations. Administrative expenses increased by 4% YoY to PKR 38 billion, remaining below the industry average, with targeted cost optimization measures delivering a 20% reduction in selected expense lines. IT spending remained focused on software and digital transformation initiatives, which have begun yielding results. Core domestic PBT increased by 32% YoY to PKR 35.6 billion, supported by revenue growth, cost efficiency, and prudent provisioning. Core international PBT declined to PKR 10 billion from PKR 12.3 billion, which included exceptional recoveries in 1QCY24; excluding these, core international PBT posted a 17% YoY increase. The bank reported a CAR of 17.9%, ROE of 18.5%, and ROA of 1.11%. HBL operated 1,675 branches across Pakistan.

Market share in agricultural finance was reported at 30%, and SME finance at 18%. On a consolidated basis, total deposits increased by 1.8% YoY to PKR 4.50 trillion. Current accounts grew by PKR 127 billion, marking the highest 1Q growth in five years, while average domestic deposits rose by PKR 226 billion, largely driven by low-cost current accounts, which increased 18% YoY. International deposits stood at PKR 2.2 billion. Total advances stood at PKR 1.9 trillion, translating to an domestic ADR of 39.9% and group ADR of 43.8%. International advances increased by 5% YoY to USD 1.5 billion.

Liquidity from advances was redeployed to investments, which reached PKR 2.8 trillion. Consumer lending remained the only growing segment, reaching PKR 148 billion. The bank’s investment portfolio comprised PKR 701 billion in fixed PIBs, PKR 1.37 trillion in floating PIBs, and PKR 415 billion in other instruments as of March 31, 2025, with an overall yield of 13.7%. Floaters accounted for 54% and fixed PIBs for 29% of the portfolio.

The loan book consisted of 35% corporate, 6% commercial, 6% consumer, 5% retail, 3% agriculture, 12% Islamic, 22% international, 4% HBL microfinance, and 7% foreign investment. The international portfolio was geographically diversified across the UK (26%), UAE (28%), Bahrain (21%), Singapore (7%), China (6%), Bangladesh (3%), Maldives (6%), and others (1%). The infection coverage ratio stood at 5.3%, with a specific coverage ratio of 90%.

Going forward, management does not anticipate a rate cut in the upcoming MPC meeting, followed by two 50bps cuts by year-end. The bank targets over 45% growth in current accounts, with sustained momentum in non-funded income expected to ease pressure on margins. Asset growth remains central to the strategy.

The revised MDR is not expected to have a material impact. The government is expected to announce measures in June 2025 aimed at boosting remittances. The ADR target for CY25 is set in the range of 40-44%, with a deposit growth target of 15-20%.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.