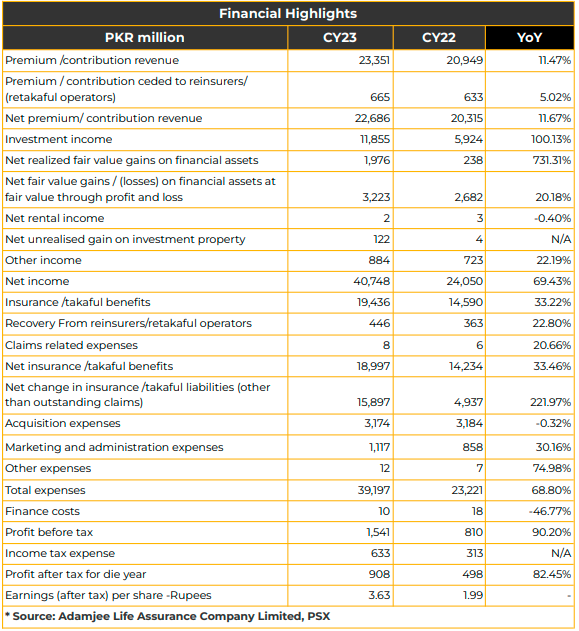

In CY23, Adamjee Life Assurance Company Limited disclosed a net profit of PKR 908.08 million (EPS: PKR 3.63), marking a substantial increase from PKR 497.70 million (EPS: PKR 1.99) in the corresponding period of the previous year (SPLY).

The company’s net insurance premium recorded a 12% year-on-year surge to PKR 22.69 billion in CY23, compared to PKR 20.32 billion in the corresponding period of the previous fiscal year. The gross premium of the company demonstrated noteworthy growth,

expanding by 11.47% to PKR 23.35 billion, primarily attributable to an upsurge in single premium policies.

Net insurance claims also witnessed significant year-on-year growth, amounting to PKR 18.99 billion in CY23. Management reported a Claims Settlement Ratio of 83% within 90 days of intimation, along with the Company’s Complaint Closure Ratio of 97% within 30 days. The complaint ratio was reported at 1.9%, lower than the regulatory level of 2%.

Similarly, investment income more than doubled to PKR 11.85 billion in CY23 from PKR 5.92 billion in SPLY. The statutory fund reserves increased to PKR 48.26 billion in CY23 from PKR 61.81 billion in SPLY.

Management reported that 15% of the total fund size is invested in equities, with the remaining allocated to government securities, bonds, and interest-based securities. In this regard, the Company adheres to a cautious investment policy. By the 25th anniversary of the insurance company, the Company forecasts a larger and better fund size.

Marketing and administration expenses escalated by 30% year-on-year, reaching PKR 1.12 billion in CY23. Profit before tax experienced a significant upsurge to PKR 1.54 billion, compared to PKR 810.31 million in SPLY.

Adamjee Life Assurance was listed on PSX on March 02, 2024, with 10% public shareholding. The insurance company offers individual life products, group life products, and digital products. However, the Company is decreasing term products for groups of members and subscribers. The PACRA IFS rating is A double plus (A++) with a stable outlook.

The major revenue drivers are Bancassurance, direct distribution, insuretech & microtech, and group life products. In CY23, ALIFE witnessed a drop in Bancassurance due to the focus of banks on interest-based income in a high-interest scenario. Moreover, increased regulations impacted the growth of this segment.

Currently, there are more than 1,000 sales representatives in the bancassurance segment, with a 10% market share in Adamjee life bancassurance. It includes both conventional and Islamic banks. Management highlighted that the direct distribution model will remain the key focus of the Company, targeting aggressive growth by 2027. The distribution model has been successfully implemented and is in the initial stage.

Private sector market share stands at 9%, with 71 sales offices and nine smart offices across the country. Apart from this, the Company is focused on microfinance institutions for digital embedding and distribution. In Group life, ALIFE owns 201 corporate accounts with premium underwritten standing at PKR 916 million in CY23. The claim ratio impressively stands at 74%. Additionally, ALIFE management indicated targeting long-term digital plans.

The total assets and total liabilities stood at PKR 86.09 billion (PKR 69.17 billion in CY22) and PKR 81.67 billion (PKR 65.42 billion in CY22) in CY23. Book value per share and Earnings per share were reported at PKR 17.67 and PKR 3.63.

In CY23, management reported a 10% dividend with a 55% payout ratio. The management indicated to follow a consistent dividend policy, in line with Nishat Group and subject to renewal book and organic growth of business. However, the insurance company prospects higher dividends after the distribution network model materializes profits by 2027.

The current ratio was reported at 1.38 times and cash & bank/current liability at 0.32. ALIFE plans to achieve growth in the ratio of cash & bank and current liability going forward.

Going forward, The Company does not see any downside impact on its equity while the country will grapple to manage the economy in 2024 due to resilient capitalization and solvent position, with total reserves standing at PKR 1.92 billion, higher than paid-up capital. However, the management anticipates lower growth, at least 5-6%, due to pressure on disposable income in the retail segment.

For CY24 and CY25, management aims to target gross premium growth to PKR 24.25 billion and PKR 25.05 billion. Similarly, the underwriting surplus is forecasted at PKR 2.89 billion and PKR 3.13 with underwriting margins at 11.92% and 12.50% respectively for the next couple of years.

ALIFE plans to introduce health insurance for the retail segment, for which the modeling and testing phase is in the initial stages. Management also plans key strategic partnerships with other financial institutions for revenue growth.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.