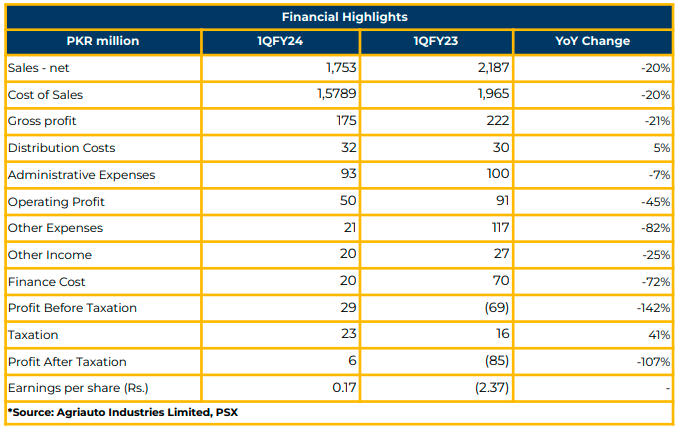

In 1QFY24, Agriauto Industries Limited reported a net profit of PKR 6.02 million (EPS: PKR 0.17), a significant improvement compared to the net loss of PKR 85.46 million (LPS: PKR 2.37) in the same period last year.

The company’s top line experienced a 27% YoY decline, totaling PKR 1.75 billion in 1QFY24, down from PKR 2.19 billion in SPLY. Gross profit decreased by 21%, amounting to PKR 174.81 million in 1QFY24 compared to PKR 221.57 million in SPLY.

Cost of sales decreased by 20% YoY to PKR 1.58 billion in 1QFY24 from PKR 1.97 billion in SPLY. However, the distribution cost increased by 5% YoY to PKR 31.99 million, while administrative expenses decreased by 7% YoY to PKR 92.91 million during the period under review.

The finance cost of the company significantly decreased by 72% YoY to PKR 19.56 million in 1QFY24.

In FY23, AGIL expanded its facilities with the establishment of an Auto-Chrome plant and the expansion of the press shop at Hub. The AIL plant

focuses on producing stamping parts for four-wheelers, two-wheelers, and tractors, and AGIL holds a dominant position as the market leader in supplying shock absorbers in the country.

The capital expenditure for the auto chrome plant at AIL is estimated at PKR 356 million, and the expansion of the press shop is estimated at PKR 441 million, adding nine additional presses of 110-250 tons.

AGIL’s product portfolio includes catalytic converters and fuel tanks for passenger cars and motorcycles.

In FY23, the production and sale of cars declined by 51% YoY, motorcycle sales decreased by 35% YoY, and tractor production and sales declined by 45% YoY. The Company’s turnover was reported at PKR 8.31 billion in FY23 compared to PKR 15.4 billion in SPLY. AGIL incurred a net loss of PKR 173.28 million in FY23, contrasting with a net income of PKR 736.821 million in SPLY.

AGIL has implemented environmentally friendly initiatives, including an effluent treatment plant and two 1MW solar plants at AIL and ASC. These solar power plants are expected to save 31,500 tons of greenhouse gases annually, equivalent to 741,100 trees.

Additionally, the Company is adding two new presses (1000 tons and 800 tons) at Agriauto Stamping Company to enhance production capacity. Management reported a bi-monthly price revision strategy based on prevailing interest rates and exchange rates in the country.

Over 50% of the Company’s sales go to Toyota and Indus Motors, with 8-9% to the secondary market. The Company utilizes 100-150 KG of cold-rolled steel sheets (CRC) per car.

Recently, the company has initiated product exports to African countries via Dubai, with plans to ship another consignment in December this year.

Management notes an increasing trend in car and tractor sales in the country. Going forward, AGIL management expects increased demand in FY24 and anticipates slightly better margins if the rupee devalues further. However, margins are contingent on interest rates, inflation rates, and foreign exchange rates. Sales are likely to increase with normalized inflation, interest rates, and exchange rates, although the management anticipates lower demand in December this year.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.