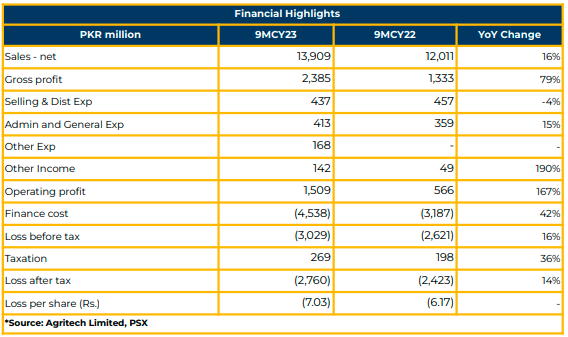

In 9MCY23, Agritech Limited reported a net income loss of PKR 2.76 billion (LPS: PKR 7.03), contrasting with PKR 2.42 million (LPS: PKR 6.17) in the corresponding period of the previous year.

The company’s revenue surged by 16% YoY to PKR 13.91 billion in 9MCY23, compared to PKR 12.01 billion in the same period the previous year. While selling and distribution expenses declined by 4% to PKR 437.18 million from PKR 456.63 in the SPLY, administration expenses increased by 15% YoY to PKR 412.93 million compared to PKR 359.23 million in SPLY.

Simultaneously, the gross profit rose by 79% YoY to PKR 2.39 billion, up from PKR 1.33 billion in the SPLY. Operating profit experienced robust growth of 167% YoY, reaching PKR 1.51 billion in 9MCY23 compared to PKR 566 million in SPLY.

The finance cost of the company increased by 42% YoY to PKR 4.54 billion in 9MCY23 compared to PKR 3.19 billion in SPLY. Additionally, the company faced a 190% YoY increase in other income, totaling PKR 142 million in 9MCY23 compared to PKR 49 million in SPLY.

Management disclosed that banks hold 40% shareholding of the Company. Moreover, the urea production in the industry declined by 1.5% to 4,764 kt due to gas curtailment in 1QCY23 and lower gas supply to SSGC network-based plants during 9MCY23.

However, industrial urea offtake increased by 3.5% to 4,945 kt due to improved farm economics and an increase in capacity. The increased production capacity (453KT) by RLNG-based plants saved PKR 31.6 billion (US $111 million forex) in 9MCY23.

In the phosphate industry, production faced a decline of 31% YoY, while offtake increased by 44% YoY due to better farm economics and an increase in the hybrid area.

Agritech’s urea market share was reported at 6% of the overall capacity of 6.8 million tons, dependent on gas supply. The company captures 70% market share in SSP with the potential to increase this market share through enhanced SSP sales and DAP imports.

During 9MCY23, gas supply days were reported at 185 days compared to 264 days in SPLY. Urea production and sales declined by 26% YoY and 25% YoY to 195K and 193K, respectively, in 9MCY23. However, the price increased by 49% YoY to PKR 2,898.

On the other hand, the production and sale of SSP increased by 23% YoY and 43% YoY to 53K and 48K, respectively, in 9MCY23.

The AGL scheme of arrangement sanctioned by LHC in 2022 became effective, and the authorized capital was enhanced to PKR 35 billion from PKR 15 billion. The company paid four tranches of PKR 1.54 billion. The issuance of preference shares and Zero Coupon PPTFCs is expected to be completed by the end of this year as the process of reconciliation of balances and verification by auditors has been initiated.

The Mianwali plant stretches over 1500 acres, of which 500 acres comprise the housing colony as reported by the management Going forward, the management anticipates robust demand for urea and SSP, and a potential urea shortage due to gas supply shortages. The management expects gas pricing reforms to settle down and anticipates undertaking production and efficiency enhancement measures in the future for both categories of Urea and SSP.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.