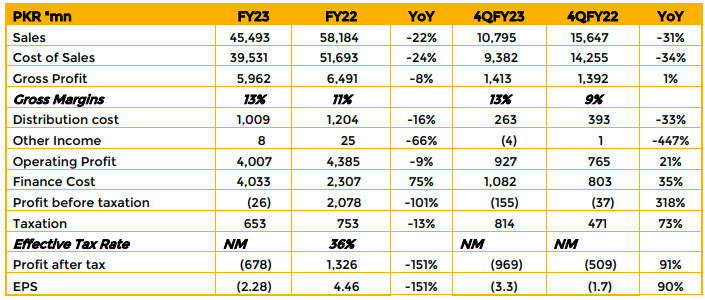

In FY23, the company recorded a net sales of PKR45.5bn,witnessed a decline of 22% YoY compared to PKR58.2bn in SPLY. Whereas, the company posted a loss of PKR678mn (LPS: PKR2.28/sh), against the profit of PKR1.32bn (EPS: PKR4.46/sh) in SPLY.

The decline is primarily attributed to lower sales volume during the noted period, contributed by series of event such as flash floods, political unrest, record high interest rates and inflation, falling reserves and measures to control CAD by restricting LCs, respectively.

Sales volume of the company clocked in at 218,279 metric tons down by 39.6% YoY in FY23, compared to 361,588 metric tons in SPLY.

During the period, prices rose by 27% YoY, primarily driven by a 35% rupee devaluation along with a significant increase in electricity cost from 21/unit to 29/unit and elevated fuel prices.

Gross margins improved by 2% to 13.11% during the year, mainly due to better prices during the said period. The substantial decline in steel bar demand, attributed to an unpredictable economic and political environment, poses a pervasive industry challenge. With inflation having peaked at 29% and with the price of steel bars having touched an all-time high of Rs.310K per, construction costs also soared, that resulted into financially burdensome for various societal segments.

Capacity Utilization of the company remained at 34% in FY23, compared to 31% in SPLY. Moreover, the current CNF scrap prices hover around USD415-417/ton, while rebar prices are at PKR268-270K per ton, respectively. Moreover, distribution expenses saw a slight decrease, driven by reduced advertising spending. Conversely,administrative costs increased by 2.06% YoY, attributed to higher depreciation and vehicle fuel expenses. The provision for expected credit loss rose by PKR114mndue to aging receivables. Operating profit also dropped 8.62% YoY toPKR377mn compared to the previous year.

Additionally, finance costs surged to PKR4.03bn, up by 75% YoY, compared to PKR2.3bn in SPLY that significantly affected the company’s bottom-line. This drastic increase in interest costs is attributed to the rise in average interest rates from 10% in FY22 to 19% in FY23. The company holds a 6% market share within the industry, with a notable 25% market share in the South region.

Regarding the Aluminum project, the management has temporarily halted operations due to working capital requirements. To note, the project initially slated to be operational in FY24.

Despite economic challenges, the Company is committed to resilience and adaptability. The management actively monitors the situation, implementing cost-saving measures. Despite prevailing headwinds, the company maintains a positive outlook, relying on market analysis for a promising steel sector turnaround next year. With anticipated increased demand and improved conditions, the management aims to seize opportunities and leveraging its strengths for growth

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose