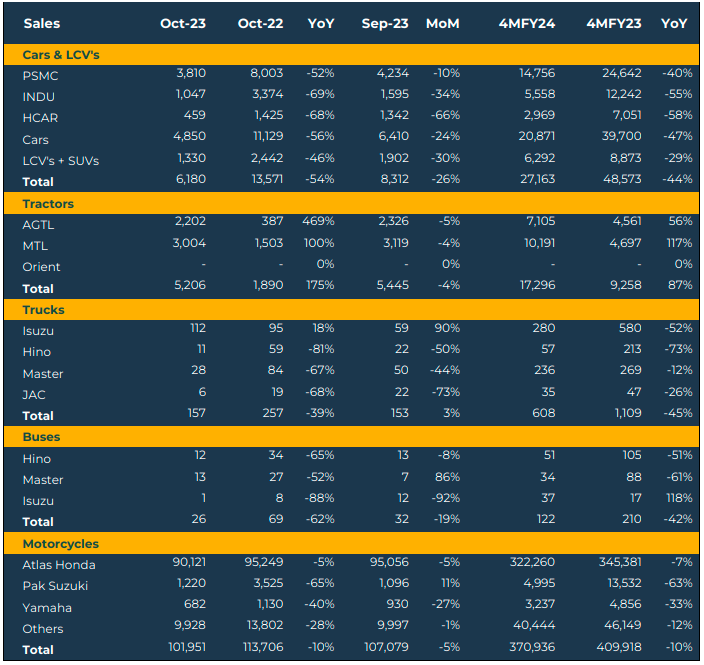

According to PAMA, Pakistan car sales decreased by 24% MoM to reach 4.85K units in Oct’23. Similarly, there was a significant year-on-year decline of 56% during the same period. In Oct’23, all automotive companies experienced a massive decrease in sales on a MoM / YoY basis, respectively.

Cumulatively, during 4MFY24, total car sales amounted to 20.8K units, reflecting a 47% YoY decline compared to the 39.7K units in SPLY. The significant deviation in sales can primarily be attributed to a slowdown in economic activities, price increases driven by rising costs, and the higher cost of auto financing.

Segment-wise, PSMC experienced a decline of 52%/10% YoY/MoM, with sales reaching 3.8K units. Similarly, the company experienced a substantial drop of 40% YoY during 4MFY24, with sales amounting to 14.75K units, as compared to the 24.64K in SPLY.

Honda Atlas Car recorded total sales of 459 units down by 66% MoM. While, in 4MFY24, HCAR sales plunged by 58% YoY to 2.97K units as against 7.05K units in SPLY.

Indus Motors (INDU) posted a decline of 69% YoY to 1.04K units in Oct’23 compared to 3.4K in Oct’22. Whereas, Sales declined by 58% YoY in 4MFY24 to 5.56K units.

Tractor sales massively recovered by 175% YoY in Oct’23. Whereas, AGTL sales improved by 469% YoY, followed by MTL sales by 100% YoY in Oct’23, respectively. Moreover, the strong farm income has started to reflect in the tractor sales. We highlight that the high agro-income and output may start to reflect in other sectors too, including autos.

Truck sales were down by 39% YoY while Buses sales declined by 62% YoY in Oct’23. This took 4MFY24 sales of Trucks to 608 units down 45% YoY, and Buses sales to 122

units down by 42% YoY, amid a drop in transportation activity followed by a slowdown in the economy.

Motorbike sales clocked in at 102K in Oct’23, down by 10% YoY. Overall, bike sales were down by 10% YoY in 4MFY24 to 371K as compared to 410K in SPLY.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose