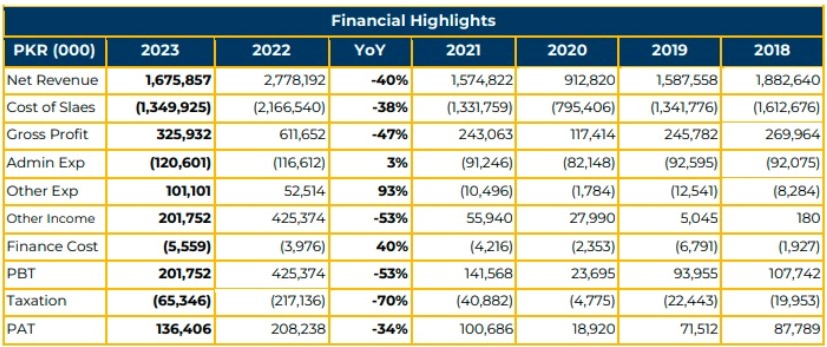

In FY23, the Company’s profitability experienced a substantial decline, dropping by 34% to PKR 136.406 million (EPS: PKR 10.23), compared to PKR 208.238 million (EPS: PKR 15.62) in SPLY. This decline in net income can be attributed to several factors, including reduced demand for automobiles due to higher prices, an interest rate hike, and the shortening of financing terms mandated by SBP.

The top-line performance of Baluchistan Wheels also suffered, with a 40% decrease in revenue, falling to PKR 1.675 billion in FY23 from PKR 2.778 billion in the corresponding period of the previous year.

Gross profit for FY23 was reported at PKR 325.932 million, marking a 47% YoY decrease compared to PKR 611.652 million in SPLY. The Company’s finance costs rose to PKR 5.559 million, reflecting a 40% increase over the same period in the previous year.

Throughout FY23, BWHL’s product sales consisted of car wheels (81.2%), tractor wheels (14.9%), and truck/bus wheels (3.9%), with production shares of 82.6%, 14.3%, and 3%, respectively, during the same period. Unfortunately, the sale of passenger cars fell by 55%, trucks by 41%, and tractors by 48%, resulting in an overall decline in total vehicle sales of 50% to 161,656 units in FY23, compared to 344,692 units in SPLY.

The management pointed out three main factors contributing to the lower sales of automobiles: (i) restrictions on LC opening, (ii) PKR devaluation, and (iii) reduced purchasing power among customers.

In terms of sales composition, local sales accounted for 94% (PKR 1.577 billion) of the total sales, while exports represented a mere 0.2% (PKR 2.9 million), and scrap sales contributed 5.71% (PKR 95.7 million) in FY23.

The Company operated at only 39% capacity utilization during FY23, compared to 76% in the corresponding period the previous year.

The acquisition of Baluchistan Wheels is contingent on regulatory approvals, and any updates on this matter will be communicated to shareholders.

Going forward, BWHL anticipates that the demand for automobiles will continue to face pressure in FY24. However, there is potential for improvement in demand if SBP lifts restrictions on the import of CKD Kits and if the rupee appreciates in the long term.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.