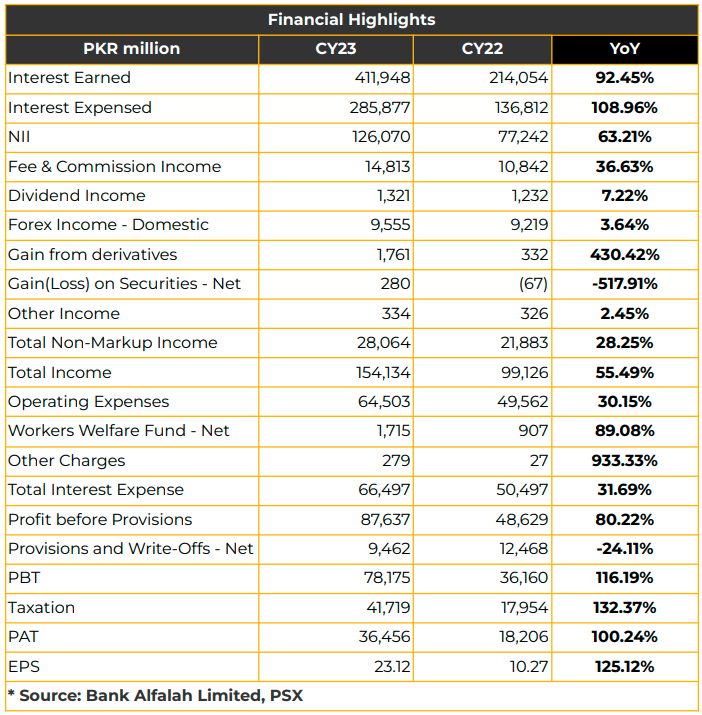

In CY23, Bank Alfalah Limited witnessed a significant surge in net profitability, reaching PKR 36.46 billion (EPS: PKR 23.12), compared to PKR 18.21 billion (EPS: PKR 10.27) in the corresponding period last year. This boost in profitability was primarily fueled by volumetric growth and higher interest rates.

The bank’s Net Interest Income (NII) surged by 63.21% to PKR 126.07 billion in CY23, up from PKR 77.24 billion in the same period last year, driven by a 92.45% increase in interest earnings (PKR 411.95 billion). Additionally, non-mark-up income rose by 28.25% YoY to PKR 28.06

billion, led by higher fee and commission income (up by 37%) and increased derivatives and brokerage income.

However, total expenses rose by 31.69% YoY to PKR 66.49 billion. The rise in administrative expenses was attributed to branch expansion, technological investments, flood donations, and marketing expenses.

Despite this, the bank witnessed a substantial 93% YoY and QoQ decrease in provisions relating to additional charges, due to prudent provisioning, including subjective downgrades and an increase in General Provisions, partially offset by investment provision reversal and recovery against written-off debts.

Moreover, the bank accounted for windfall tax on foreign exchange income, resulting in taxation increasing to PKR 41.72 billion in CY23. The Net Interest Margins (NIMs) expanded by 5.4% due to deposit growth and higher interest rates, while the cost-to-income ratio decreased to 41.8%. The bank reported ROE and ROA at 32.5% and 1.4% respectively in CY23.

Bank Alfalah Limited held market shares of 6.9% in deposits, 5.9% in advances, 8.5% in trade, and 14.2% in remittances. Consumer lending, SMEs, and Islamic financing drove advances market share growth. The bank experienced robust growth in deposits, crossing the PKR 2 trillion mark (40% YoY increase), with current deposits increasing by 19.5% YoY in CY23. This growth was attributed to branch expansion, improved staff productivity, and effectively executed strategies.

Furthermore, Bank Alfalah Limited ranked second in home finance, credit card ENR, and credit card acquisitions. In auto finance, the bank held the third position with a 14.2% market share. The deposit mix comprised 38% current deposits, 31% savings deposits, and 31% term deposits, with conventional deposits accounting for 75%, Islamic for 17%, and overseas for 8%.

However, advances remained flat due to cautious lending and provisions, resulting in a lower gross ADR (37.3%). The infection ratio decreased to 4.8% due to subjective classification. Nevertheless, the coverage ratio remained healthy at 112.2% in CY23.

Investments witnessed a significant 86% YoY surge, with the portfolio tilted towards floating PIBs and T-Bills. The share of fixed PIBs stood at 15%, with an average yield of 14% for 2-2.5 terms, while the share of T-Bills and floating PIBs stood at 25% and 60% respectively. The repricing

frequency of floating PIBs was reported as 2.5-3 months.

The Capital Adequacy Ratio (CAR) stood at 16.74%, and the CASA ratio improved to 69.3% due to increased deposit growth in CY23. The book value per share improved to PKR 87.45, with current accounts (CA) constituting 38% due to a shift from current to savings and term deposits to capitalize on market opportunities.

Bank Alfalah Limited operated 1024 branches, including more than 350 Islamic Branches, in 225 cities of Pakistan. It had an international presence with ten international branches and one offshore banking unit in four countries, including two branches in Afghanistan.

Additionally, the bank inaugurated its first-ever Digital Lifestyle Branch in Zamzama Karachi, equipped with biometrically secured lockers, a digital floor with self-service kiosks, BNPL store, and a virtual service machine for account opening.

Digital throughput and migration ratios improved by 84% (PKR 4 trillion) and 77% YoY in CY23. G2P payments increased by 39% to PKR 137 billion, and digital lending grew by 74% to PKR 19.5 billion during the stated period.

AlFA Mall ranked second after Daraz in E-Commerce and had a return of PKR 9.8 billion (94% up) in CY23.

Bank injected PKR 1.2 billion in Alfalah CLSA due to the receivables which were eroding the equity, improving the equity of the bank.

Going forward, the management anticipates continued growth in marketing expenditures and deposits, aiming for a deposit growth of 15%-20% and an increased market share in CY24. Additionally, they aim for a consistent payout, with a quarter-on-quarter dividend payout in consideration. The status of the expected ADR tax will be confirmed in the upcoming budget, as per management.

In CY24, the bank aims to expand its branch network with 150 more branches, including 100 Islamic branches. The bank expects the profitability to normalize in the upcoming quarters. Additionally, the bank’s strategy is geared toward volumetric growth, given expected lower interest rates. The management anticipates a rate cut of 100 bps in April.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or

indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.