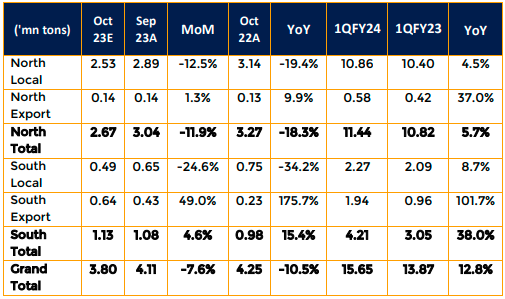

Pakistan’s total cement sales for October 2023 are expected to witness a decline of 11% YoY, reaching an estimated 3.80 million tons. While, on a cumulative basis, total sales is anticipated to increase by 13% YoY in 4MFY24 to 15.65 million tons. The growth is driven by the expected recovery in local demand following by low base effect due to floods and a pickup in exports.

Lower coal prices than last year along with a gradual increase in cement prices is expected to increase margins going forward and we remain overweight on the sector due to its solid cash generation and cheap valuations. Cement companies are trading significantly below replacement value and we expect valuations to revert to the mean once economic uncertainty reduces. Cement sector returns in the past have majorly been led by sector pricing discipline rather than cement dispatches.

We indicate a promising outlook for the cement industry due to potential economic recovery and political stability. We believe that cement export from the south zone could show significant growth in FY24 as lower coal prices have made companies competitive again.

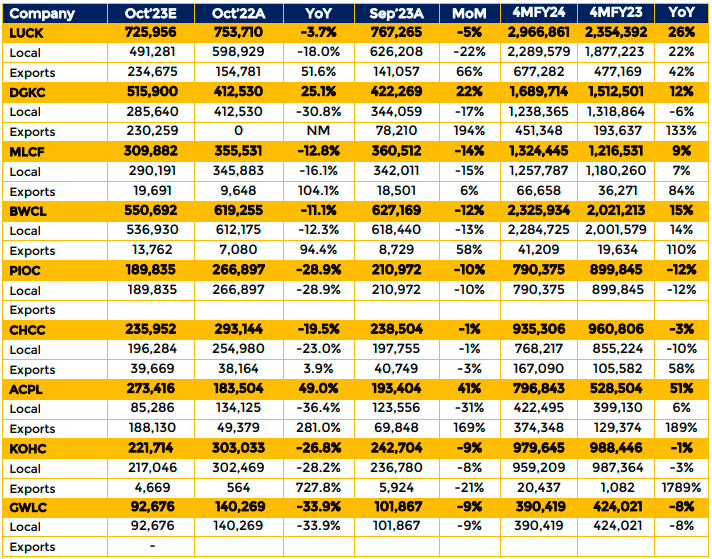

Company wise expected Cement Dispatches

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.