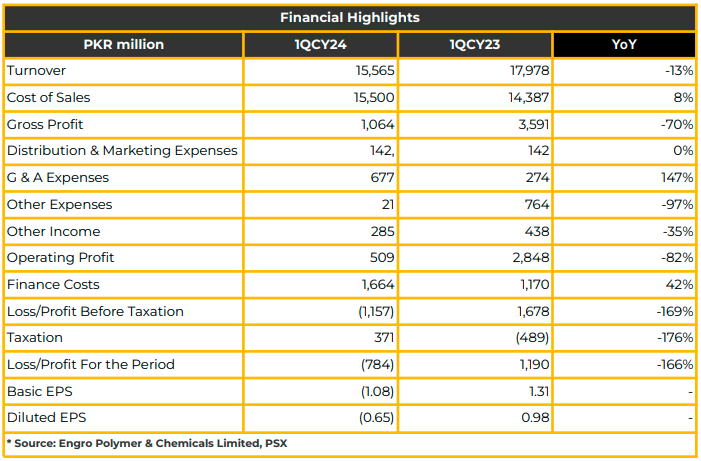

In 1QCY24, EPCL recorded a substantial net loss of PKR 784.32 million (LPS: PKR 1.08), marking a significant decline from the prior year’s net profit of PKR 1.19 billion (EPS: PKR 1.31).

The company attributed this decline in profitability to factors such as slower domestic sales, increased inflation, devaluation, lower core delta, and adverse budgetary impacts. The cost of sales witnessed an 8% YoY increase to PKR 15.5 billion during this period.

EPCL’s total revenue reached PKR 16.56 billion, reflecting a 8% YoY decline from the preceding year. The decline in revenue was attributed to lower international PVC prices coupled with slower domestic PVC demand. However, this decline in PVC was partially offset by higher caustic domestic sales.

Segment-wise, PVC generated PKR 13.23 billion (compared to PKR 15.78 billion in 1QCY23), while Chlor Alkali contributed PKR 3.29 billion (compared to PKR 2.17 billion in 1QCY23).

EBITDA declined by 82% YoY due to lower core delta (USD 279 per MT) and inflationary pressure. EPCL reported a decline in exports to USD 2.1 million,marking a 65% YoY decrease. Simultaneously, gross profit decreased by 70% YoY to PKR 1.06 billion from PKR 3.59 billion in the same period last year.

PVC incurred loss after tax of PKR 1.41 billion (compared to PAT: PKR 995 million in 1QCY23), Chlor Alkali PAT of PKR 508 million (compared to PKR 177 million in 1QCY23), and others at PKR 1 million in 1QCY24.

In the same period, EPCL sold 45KT of PVC, a decrease of 14% YoY from the previous year’s 52KT in 1QCY24. The domestic PVC market faced challenges due to political uncertainty, reduced construction activity, higher inflation, devaluation, prolonged winter, and higher energy costs.

Downstream demand was further impacted by rising steel prices, higher finance costs, and availability of new housing inventory. Logistics and raw material costs significantly impacted the PVC market.

PVC international prices remained within the range of USD 768-797 per MT in 1QCY24. The sale breakdown for PVC applications in 1QCY24 was: Fittings (50%), Film & sheet (20%), Profile (7%), Cable Compound (7%), Shoe (7%), Flexible Hose (4%), Others (5%).

Similarly, EPCL sold 14KT of liquid and 3KT of Flakes (Total of 17KT of Chlor Alkali), 21% higher than the previous year. Caustic Soda prices remained under pressure due to limited supply as a result of offline plants during Lunar New Year and firm freight rates.

However, domestic market margins improved, driven by a decline in international prices. Supply to the domestic Export-Oriented sector was maintained at 78% in 1QCY24.

Ethylene prices experienced volatility due to instability in the global oil & gas prices and tight supply in 1QCY24. Starting Mid-January, Ethylene prices rose from $875 MT to $1,050 MT in 1QCY24. Operating rates of steam crackers declined during 1QCY24.

Management shared that the Hydrogen Peroxide project’s completion is expected in CY24.

The management highlighted that the availability of gas at competitive prices remains a key challenge. During the same period, EPCL received gas at 40% nomination.

Management reported an increase in captive gas prices to PKR 2,750 mmbtu and a decline in industrial gas prices to PKR 2,150 mmbtu.

Despite a significant 97% decline, other expenses totaled PKR 20.97 million in 1QCY24, down from PKR 764.03 million the previous year. Meanwhile, other income decreased by 35% YoY to PKR 285.11 million in 1QCY24.

Due to higher policy rates, EPCL’s finance costs rose 42% YoY to PKR 1.66 billion from PKR 1.17 billion. Loss before taxation clocked in at PKR 1.16 billion in 1QCY24, with taxation reaching PKR 371.38 million during the same period.

Going forward, the company anticipates operational sustainability and timely completion of ongoing projects. Economic stability is expected to support operations. However, bearish international prices due to oversupply might continue to impact PVC sales. Nonetheless, narrow producer margins are likely to limit further price cuts.

Domestically, the construction sector is expected to rebound after Eid. Additionally, higher crude oil prices might further increase ethylene prices. EPCL is also exploring alternative power solutions. The domestic caustic demand outlook is positive on the back of LSM sector recovery and textile exports.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.