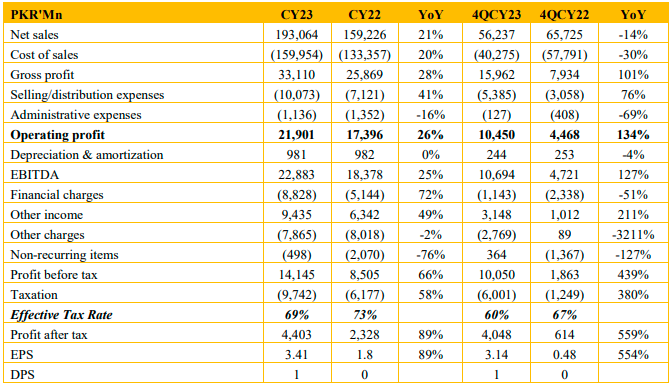

The company recorded net sales at PKR 193 Bn in CY23 registering an increase of 21% against PKR 159 Bn in CY22.

Gross profit increased 28% to PKR 33 Bn in CY23 from PKR 25.9 Bn in CY22. As a result operating profit rose 26% from PKR 17.4 Bn in CY22 to

PKR 21.9 Bn in CY23.

FFBL recorded profit before tax of PKR 14.1 Bn in CY23, up 66% when compared to PKR 8.5 Bn in SPLY.

Taxation expense for the year stood at PKR 9.7 Bn in CY23, up 66% compared to PKR 6.2 Bn in CY22.

Profit after tax surged 89% from PKR 2.3 Bn in CY22 to PKR 4.4 Bn in CY23. Similarly, EPS rose 89% from PKR 1.8 during CY22 to PKR 3.41 in CY23.

The company also announced a dividend of PKR 1 for CY23 as compared to no dividend in CY22.

The DAP market sales grew by 34% in CY23 to 1,569 KT compared to 1,176 KT in CY22. In CY23, FFBL was able to maintain a 54% market share in DAP down 2% from 56% in CY22.

FFBL recorded sales of 846 KT in CY23, an increase of 28% when compared to sales of 661 KT in CY22. On the other hand, Urea sales saw a decline of 36% from 523 KT in CY22 to 336KT in CY23. This was driven primarily by lower production due to

gas shortfall.

The company is of the view that there would be no need for urea import if sufficient gas is provided to producers. Additionally, as the gas shortage caused production bottlenecks it expects DAP market share to reduce as supply normalizes and industry production increases.

The company is also expecting to launch a new value-added product, Boron fortified DAP in order to overcome Boron deficiency. It estimates that about 60% of Pakistan’s soil is deficient in Boron resulting in loss of yield in particular with wheat.

FFBL expects to launch this product in the first half of 2024 with a modest production volume planned for this year and growth in production and sales in the coming years.

The company also faces increased shipment times for raw materials due to conflict in the Red Sea causing the shipment time for orders to go up as

ships are rerouted through the Cape of Good Hope. The additional shipping time is about 10 days according to management.

The company has also successfully completed the sale of Fauji Meat Limited to Fauji Foundation for PKR 4.3 Bn. Its subsidiary Fauji Power Company Limited has also reported a 22% increase in gross profit over 2022. Fauji Foods, another subsidiary, has also achieved a profit after tax of

PKR 0.61 Bn in CY23 against a loss after tax of PKR 2.2Bn in CY22.

FFBL still views inflation as a challenge, however moving forward it expects the benchmark rate to come down helping it drive sustained profitability.

It believes that the largest challenge it faces is gas availability as it is still on the SSGC network. Therefore all efforts are being made for provision of

gas.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under

no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.