In 1QCY25, Fauji Fertilizer Company reported a net profit of PKR 13.28 billion (EPS: PKR 9.33), up 26% YoY from PKR 10.52 billion (EPS: PKR 8.27) in the same period last year. Profitability was supported by contributions of PKR 8.1 billion from the fertilizer segment, PKR 2 billion from dividend income, and PKR 3.2 billion from investment income. Fertilizer business contributed 61% to overall profitability.

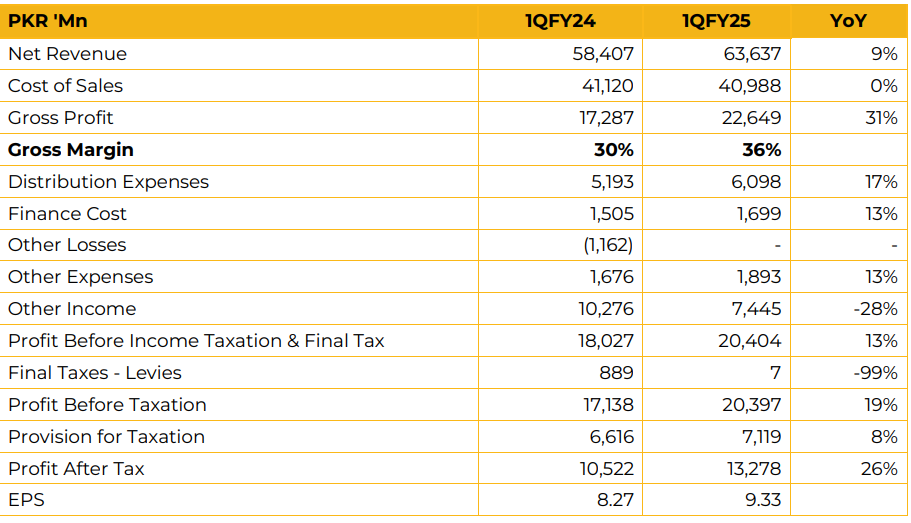

Revenue grew by 9% YoY to PKR 63.64 billion, compared to PKR 58.41 billion in 1QCY24, while gross profit increased by 31% YoY to PKR 22.65 billion. Despite the topline growth, investment and dividend income declined to PKR 7.4 billion from PKR 10.3 billion in the same period last year.

FFC accounted for 40% of industry production and held 16% of total industry inventory, the lowest in the sector. Urea market share rose to 49% in 1QCY25 from 45% in the prior year, while DAP market share declined to 63% from 66%. The increase in urea share was attributed to marketing initiatives. Management reported a benefit of USD 135 million passed on to farmers during the quarter.

Production during 1QCY25 declined by 13% due to planned turnarounds at Goth Machhi and Port Qasim plants. Aggregate urea production stood at 629 KT, including 588 KT from Sona P and 41 KT from Sona G. DAP output stood at 168 KT, with no imports during the quarter.

Urea inventory was reported at 132 KT in 1QCY25, up from 31 KT in CY24, while DAP inventory increased to 110 KT from 11 KT. Offtake figures included 503 KT for Sona P, 35 KT for Sona G, 64 KT for Sona DAP, and 24 KT for imported DAP. Urea demand was impacted by a 6.4% decline in wheat sowing, reducing offtake by 155 KT, and weak rainfall in Barani regions, further reducing demand by 240 KT. The company operates 100 retail outlets across Pakistan, serving 81,000 registered farmers and covering 1.1 million acres of farmland. It maintains partnerships with seven banks—four offering collateral-free loans—and has collaborations with leading insurance firms.

Stock-in-trade rose to PKR 43 billion. Short-term investments and borrowings were reported at PKR 140 billion and PKR 12 billion, respectively. The debt-to-equity ratio stood at 20:80. On the Agritech merger, management stated that FFC has representation on AGL’s board. No discounting on urea sales was reported, and FFC has no future plans for discounts. Phase I of the Pressure Enhancement Facility project is expected to complete in 1HCY25, while Phase II is targeted to be completed by 2HCY26. Compressors are scheduled for import in July/August.

The total investment stands at USD 60 million, with USD 52 million allocated to Phase I. The gas supply agreement with Mari Petroleum remains in place until 2029. The GIDC case is currently under process. Going forward, management anticipates current oversupply in the market to be temporary, expecting stronger demand in upcoming seasons. The company expects to achieve shariah-compliant status within the next 2–3 months.

Dividend income from FPCL is expected in 2HCY25 following debt clearance. Management emphasized the need for timely deregulation of the market in the absence of wheat support pricing and reported no ongoing discussions with the government regarding urea exports. Industry inventory levels are expected to reach 400,000–450,000 tons in CY25.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.