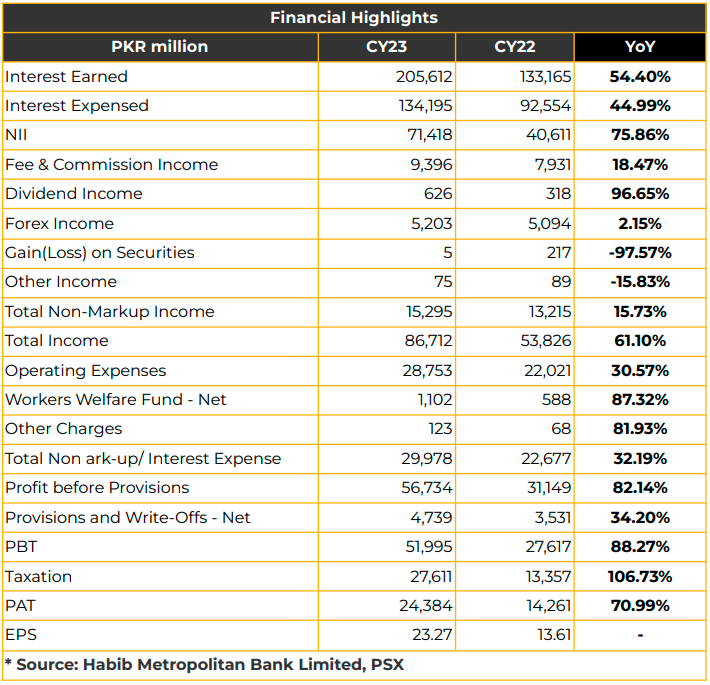

In CY23, HMB reported a record unconsolidated profit of PKR 24.38 billion (EPS: PKR 23.27), marking a 71% YoY increase from PKR 14.26 billion (EPS: PKR 13.61) in the corresponding period of the previous year.

Profit before tax reached PKR 51.99 billion, marking an 88% YoY increase from PKR 27.62 billion last year. The bank experienced income growth of 61% YoY to PKR 86.71 billion in CY23, up from PKR 53.83 billion last year, driven by robust growth in NII.

Net Interest Income (NII) surged by 76% to PKR 71.42 billion in CY23, propelled by a 54% YoY increase in interest earnings (PKR 205.62 billion).

Non-markup income increased by 16% to PKR 15.29 billion, fueled by fee commission income (PKR 9.40 billion). The bank witnessed an increase in dividend income and foreign exchange of 97% and 2% to PKR 625.58 million and PKR 5.20 million respectively in CY23. Conversely, HMB experienced a decline of 98% and 16% in securities and other income.

Total income increased by 61%, resulting in a cost-to-income ratio of 34.6% in CY23, compared to 42.1% last year. The infection ratio reached 4.5%, lower than 4.8% in CY22, due to robust recoveries, cautious lending, and asset quality.

On a consolidated basis, the bank’s PBT increased by 87% YoY to PKR 53.12 billion in CY23 from PKR 28.47 billion in CY22.

Total deposits and current deposits grew by 15% (PKR 1.01 trillion) and 22% respectively, predominantly from low-cost deposits. Total deposits slightly lag behind industry levels.

Gross advances stood at PKR 439 billion, down 4% YoY, with an ADR of 43.3% in CY23. Advances remained subdued due to macroeconomic challenges. However, the CAGR of advances, 11.8%, exceeds industry levels.

Although advances in the textile sector have decreased, management believes this sector will remain pivotal in Pakistan’s economy.

The loan portfolio comprises Textile (42%), others (18%), edibles (9%), commodity finance (8%), utilities (6%), electronics (4%), individuals (4%), and commercial trade (4%).

The investment mix comprises federal government securities (97%) and others (3%). Investment in treasury bills constitutes 37% of federal government securities, Islamic Naya Pakistan Certificates 1%, PIBs (53%), and Ijarah Sukuks (9%).

Fixed PIBs constitute 27%, while floaters constitute 37% of the total investment bonds portfolio. Management reported that 35% of the PIBs are maturing in CY24.

The bank made significant recoveries in CY23 and expects to sustain this momentum in CY24.

The CAR, ROA, and ROE stood at 18.26%, 1.7%, and 30.3% respectively in CY23. The bank’s operating expenses increased by 31% YoY to PKR 28.75 billion.

Islamic banking deposits grew by 38% YoY and CA deposits by 67%, while Islamic financing increased by 7% YoY. Islamic banking assets constitute 14% of total assets and grew by 32% YoY in CY23. Management reported that 9% of the total bank’s foreign trade is Islamic.

HMB operates 117 Islamic branches (22% of the total network). The bank witnessed an 81% increase in Islamic profit before taxation in CY23. The branch network spans Pakistan with 525 branches in over 200 cities. The bank plans to invest in 26 new branches by year-end.

In digital banking, the bank observed an increase in transaction volume via Mobile and IB. The implementation of IFRS-9 is unlikely to affect the bank’s financials as it is fully compliant and does not anticipate major changes in its capital structure.

HMB plans to expand in the current financial year by opening new branches (Conventional and Islamic). HMB invested PKR 1 billion equity in its exchange, which will commence operations after regulatory approvals. Looking ahead, HMB anticipates a reduction in interest rates and plans to grow revenue by increasing volume, given the macroeconomic conditions. Additionally, it expects dividend sustainability.

Moreover, the bank management foresees no government debt restructuring. Additionally, management aims to grow deposits while fostering robust advances in the corporate sector.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or

indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.