Key Takeway

Hoeschst to Broaden Pharma Product:

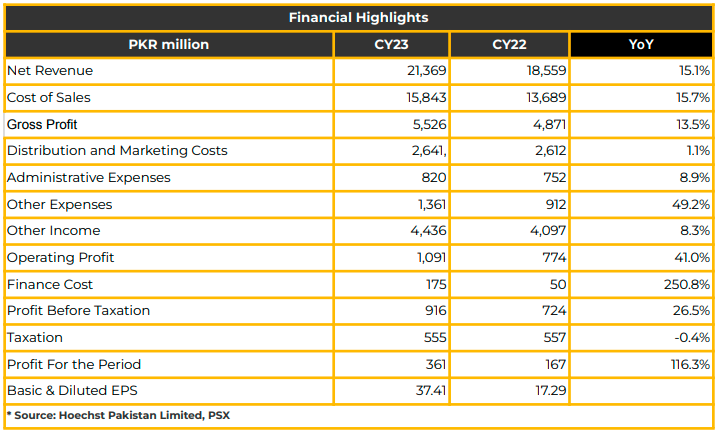

Portfolio with Two New Launches in CY24 In CY23, HPL reported a net profit of PKR 360.81 million (EPS: PKR 37.41), marking a robust 116% YoY increase from PKR 166.78 million (EPS: PKR 17.29) in SPLY. Profit Before Tax (PBT) reached PKR 916.09 million, notably improved from PKR 724.07 million in the corresponding period.

This achievement is attributed to an enhanced focus on controlling operating costs and efficient management of working capital and treasury.

Net sales grew modestly by 15% to PKR 21.37 billion in CY23 compared to PKR 18.56 billion in CY22, with the flagship product, Flagyl, contributing significantly to revenue growth (PKR 5 billion).

Cost of sales surged by 16% to PKR 15.84 billion in CY23 compared to PKR 13.69 billion in CY22. Distribution and marketing expenses slightly increased by 1.1% to PKR 2.64 billion in CY23 compared to PKR 2.61 billion in SPLY. Maintaining gross margins at 26%, HPL’s market share stands at 2.5%, with 15% growth, ranking 13th in the Pharma industry.

Administrative expenses saw a 9% YoY increase, reaching PKR 819.57 million compared to PKR 752.50 million in CY22, while other expenses increased by 49% to PKR 1.36 billion from PKR 912.17 million in CY23. Other income saw a significant boost, rising by 8% YoY to PKR 4.44 billion, attributed to an increase in treasury income (PKR 108 million).

Finance costs significantly increased to PKR 174.77 million in CY23 from PKR 49.83 million in SPLY. Operating profit increased by 41% to PKR 1.09 billion in CY23 from PKR 773.89 million in CY22.

The portfolio mix comprises core business (42%), Diabetes (16%), Consumer Healthcare (14%), Cardiology & Specialty (12%), others (14%), and oncology (2%).

General Medicine Classics witnessed a 12% growth (PKR 7.3 billion), diabetes 26% (PKR 3.93 billion), EP&CV 18% (PKR 4.69 billion), CHC 31% (PKR 2.76 billion) in CY23. In April 2023, the Investor Consortium, comprising Packages Limited, IGI Investments (Private) Limited, and affiliates of Arshad All Gohar Group, acquired the entire 52.87% shareholding of Sanofi-Aventis Pakistan Limited. As a result, Sanofi-Aventis Pakistan was rebranded as Hoechst Pakistan Limited.

Packages Group’s shareholding increased from 25% to 72% after this SPA. The shareholding structure changed to Packages (42%), IGI Investments (25%), Directors, families & affiliates (6%), AAG families & affiliates (21.9%), financial institutions (5%), and the general public (2%).

During the first two-quarters of CY23, revenue growth was reported at 9% and 3%, while the third and fourth quarters saw growth of 29% and 22%, respectively. Due to seasonality impact and supply-chain disruptions, the demand for Flagyl and diabetic products increased in Pakistan in 2HCY23.

On a positive note, the pharma company successfully turned losses (PKR 357 million in 1QCY23 and PKR 165 million in 2QCY23) during 1HCY23 into positive growth in 2HCY23 (PKR 469 million and PKR 414 million in 2Q and 3Q).

Management reported a 14% and 20% increase in essential and other drug prices in CY23. A tax refund of PKR 250 million was reported by the Company during the same period.

Going forward, HPL plans to launch two new products in CY24 while expanding its product portfolio. Additionally, the Company plans to export its products in the medium to long term.

Management aims to increase outreach in vaccines while improving margins to align with industry levels over the next three years. Sales growth, cost control, and efficient working capital management will be the company’s strategies to enhance margins.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.