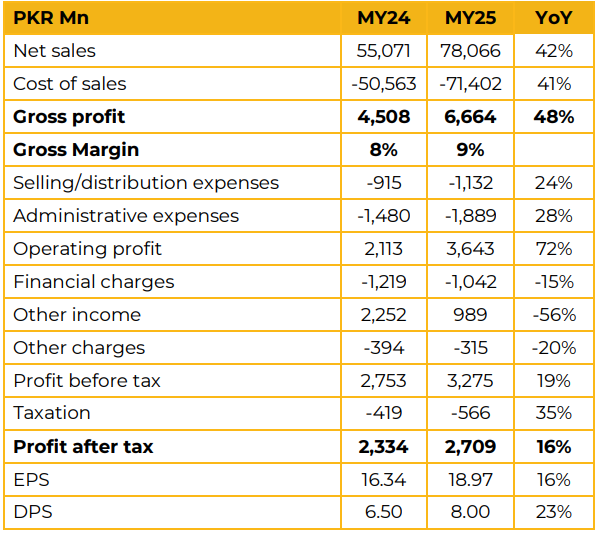

Honda Atlas Cars (Pakistan) Limited reported earnings per share of PKR 18.97 in MY25 against earnings per share of PKR 16.34 in MY24 an increase of 16%.

Net revenue in MY25 reached PKR 78.1 Bn, a rise of 42% compared to MY24 with PKR 55.1 Bn. The company saw its gross margin increase from 8% in MY24 to 9% in MY25. HCAR launched a new hybrid variant of its HR-V model on July 14th 2025. The management apprised that the response has been positive and it expects to sell 400-500 units per month on average in the first year.

The company’s bestselling model, City, has a sales mix of 75:25 between 1.2L and 1.5L respectively. Management also highlighted that despite falling steel prices it expects pressure on margins due to depreciation and the absorption of the NEV adoption levy.

The localization levels of HCAR’s models are as follows:

Civic: 64%

City: 74%

HR-V: 61%

BR-V: 52%

Management expects that after the expiration of incentives under the 2021-26 auto policy it will reap the benefits of localization due to a level playing field with its competitors.

Going forward, the management was optimistic about volumetric growth with 40-50% volumes growth expected in MY26.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.