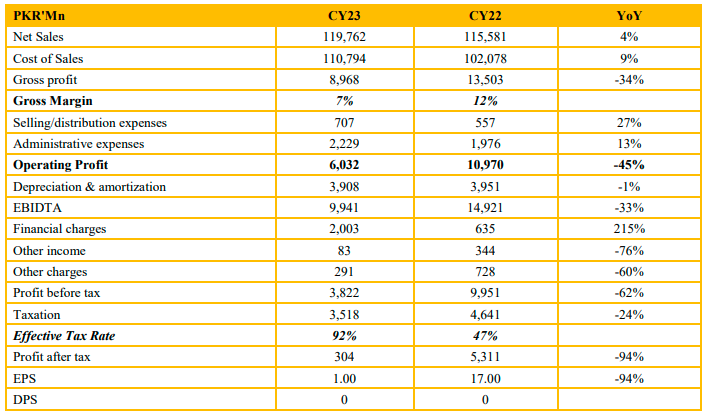

Ibrahim Fibres Limited reported net sales of PKR 120 Bn in CY23, up 4% from PKR 115.6 Bn in CY22.

Cost of sales reached PKR 111 Bn in CY23 against PKR 102 Bn in CY22 showing an increase of 9%. As a result, gross profit fell 34% to PKR 9 Bn in CY23 against PKR 13.5 Bn in CY22. Similarly gross margins fell from 11.7% in CY23 to 7.5% in CY22.

The company saw its distribution expenses swell to PKR 707 Mn in CY23 from PKR 557 Mn in CY22, an increase of 27%. Administrative expenses saw a 13% increase from PKR 1.98 Bn in CY22 to PKR 2.2 Bn in CY23. Ibrahim Fibres Limited saw a 45% drop in its operating profit in CY23 to PKR 6 Bn from PKR 11 Bn in SPLY.

Depreciation and amortization expenses saw a marginal drop of 1% from PKR 3.95 Bn in CY22 to PKR 3.91 Bn in CY23.

The company reported finance costs of PKR 2 Bn in CY23 representing an increase of 215% when compared to PKR 635 Mn in CY22.

Profit before tax was reported at PKR 3.8 Bn in CY23, down 62% against PKR 10 Bn in CY22.

The company also saw its effective tax rate rise from 47% in CY22 to 92% in CY23. Taxation costs fell 24% from PKR 4.6 Bn in CY22 to PKR 3.5 Bn

in CY23.

Ibrahim Fibres Limited saw profit after tax for CY23 reach PKR 304 Mn, down 94% when compared to PKR 5.3 Bn in CY22.

The company has a peak power demand of 40MW and does not actively use energy from the grid however does have a standby arrangement with WAPDA if needed. It has the capacity to produce 20 MW from coal power and 15 MW from gas turbine along with solar power facility also available.

As a result, the management estimates that its power costs are 40% lower than purchasing from WAPDA.

The company receives a blended mix of gas at an about $13 per MMBtu. Going forward the company expects smuggling to continue to impact

demand in the local market however does expect the situation to get better in the next 4-5 years.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose