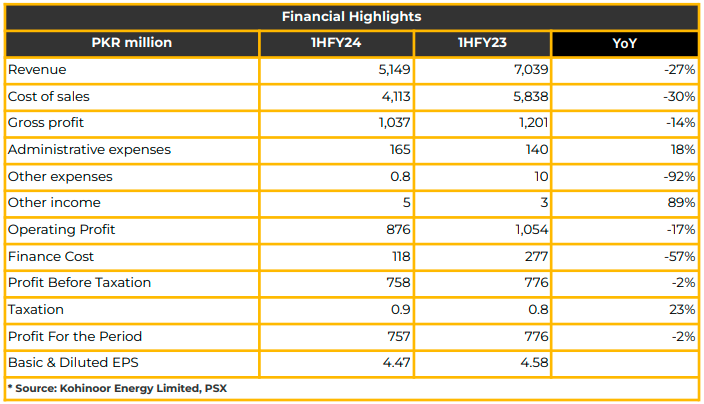

During 6MFY24, Kohinoor Energy Limited (KOHE) reported a net profit of PKR 757.29 million (EPS: PKR 4.47), marking a 2% YoY decrease from PKR 775.59 million (EPS: PKR 4.58) in the corresponding period of the prior year. The decline in profitability was attributed to significant maintenance work undertaken during the half-year.

Revenue for 6MFY24 stood at PKR 5.15 billion, representing a 27% YoY decrease from PKR 7.04 billion in the same period of last year. Gross profit also declined by 14% YoY to PKR 1.04 billion.

The Company witnessed a 30% YoY decrease in its cost of sales to PKR 4.11 billion, while administrative expenses increased by 30% YoY to PKR 164.82 million in 6MFY24. The shareholding pattern of KOHE comprises Wartsila Finland (2%), General Public (36%), and Saigols Group (62%).

In the Annual Dependency Test, the generation company increased its capacity to 128.66 MW against the contractual obligation of 124 MW. Management assured that KOHE faces no risk of default as it is a debt-free entity, having repaid all its long-term debts in FY08.

Current assets and liabilities were reported at PKR 4.77 billion (compared to PKR 6.92 billion in FY22) and PKR 1.75 billion (compared to PKR 4.70 billion in FY22) respectively for FY23. In 6MFY24, these figures stood at PKR 5.54 billion and PKR 3.53 billion respectively. Management indicated that the Company is managing its short-term financial needs with sufficient availablecash and is committed to maintaining a consistent

dividend payout.

Kohinoor Energy witnessed a decline in dispatches from 47% in FY22 to 30.3% in FY23. Dispatches during 1HFY24 stood at 19.11%. The management attributed this decline to higher furnace oil prices, stagnant growth, and the availability of cheaper alternatives in the country.

The finance cost of the company decreased by 57% YoY to PKR 118.11 million in 6MFY24, compared to PKR 277.25 million in the same period last year.

Going forward, management expects the circular debt issue to persist unless substantial reforms are introduced by the government. Negotiations for the renewal of the Power Purchase Agreement (PPA), expiring in 2027, are anticipated to commence in the next financial year, with hopes for renewal granted given the Company’s unique central location.

Given the higher energy demand, the management anticipates sustained demand for furnace oil plants in the upcoming years. However, the KOHE is actively exploring alternative options in this regard.

Management aims to maintain consistent dividend payments unless new investments are necessitated under the new PPA agreement.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.