Key Takeway

Company Maintains Lower Payout Ratio Amid Cash Flow Optimization and Debt Reduction Strategy

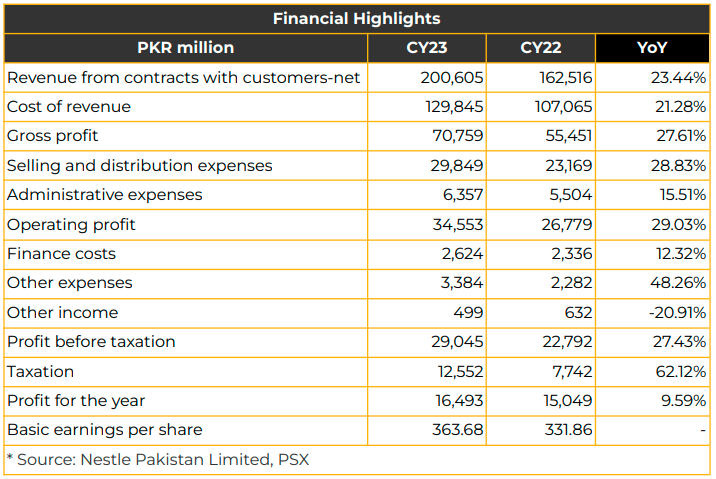

In CY23, Nestle Pakistan Limited reported a net profit of PKR 16.49 billion (EPS: PKR 363.68), marking a robust 10% YoY increase from PKR 15.05 billion (EPS: PKR 331.86) in SPLY. The decline in the bottom line was attributed to the imposition of a super tax, with a reported effective tax rate exceeding 40%.

Profit Before Tax (PBT) reached PKR 29.04 billion, notably improving by 27% YoY from PKR 22.79 billion in the corresponding period, driven by controlled operating costs and efficient management of working capital.

Net revenue grew by 23% to PKR 200.61 billion in CY23 compared to PKR 162.52 billion in CY22, with 90% of revenue growth attributed to price increases and 10% to volume growth, while exports of products doubled in CY23. Moreover, the increase in revenue was attributed to portfolio enhancement, demand-generating activities, and price initiatives,The revenue mix comprises Dairy & Nutrition (79.3%), Beverages (20.2%), and others (0.5%), with 26% of sales originating from the north, 29% from the center, and 27% from the South.

Dairy & Nutrition sales increased by 26.9% to PKR 160 billion; however, operating margins remained stable at 18.9% despite inflationary and forex challenges.

The market share of the company reported at 7-8% for milk and branded products, and for beverages, it stands at 30%.

ROCE was increased 153% in CY23 from 125% in SPLY, while cash flow was reported at PKR 39 billion compared to PKR 29 billion in SPLY.

Beverages sales increased by 11.6% to PKR 40.6 billion, with profit margins improving to 10.6% in CY23 from 8.2% in SPLY due to better optimization of fixed costs. Cost of sales surged by 21% to PKR 129.84 billion in CY23 compared to PKR 107.06 billion in CY22. As a result of cost reclassification, the royalty charges of PKR 5.8 billion were added to selling & distribution in 4QCY23 from COGS, with management reporting that selling and distribution expenses will continue to rise due to continued marketing expenses and royalty charges.

Administrative expenses saw a 16% YoY increase, reaching PKR 6.36 billion compared to PKR 5.50 billion in CY22, while other expenses increased by 48% to PKR 3.38 billion from PKR 2.28 billion in CY23. Other income witnessed a significant decline, down by 21% YoY to PKR 499.49 million.

Finance costs significantly increased by 12% to PKR 2.62 billion in CY23 from PKR 2.35 billion in SPLY, with management indicating a plan to payoff Foreign IntraGroup (FIG) loan of USD 5.1 million in a single installment after three years.

Operating profit increased by 29% to PKR 34.55 billion in CY23 from PKR 26.78 million in CY22 due to the localization of raw and packaging materials, an increase in exports, a favorable product mix, and tight control on fixed costs.

In CY23, Nestle incurred a total CAPEX of PKR 20.9 billion on sustainability projects, including PKR 3.4 billion in CY23. Nestle operates three solar plants in Sheikhupra (2.6MW), Islamabad (266 KW), and Kabirwala Factory (2.5MW). Management indicated to add four more clean drinking water facilities, following the successful establishment of six water treatment plants.

Additionally, Nestle successfully reduced carbon emissions by 17.3%, with a target to reduce emissions by 20% by 2025, 50% by 2030, and achieve net zero emissions by 2025.

Nestle launched four new products with complete localization of Ice Mixers in CY23, procuring raw materials from 24,870 farmers worth PKR 51.9 billion, with plans to procure fruits locally from Gilgit Baltistan, Sindh, and Swat regions. Apart from this, the Company recycled 2,600 tons of waste in collaboration with the Gilgit-Baltistan Government.

Going forward, Nestle plans to expand exports and improve volumetric growth with product innovations, Fruit localization is also planned for CY24, and the Company is assessing how to deleverage, with no plans of bonus issues in the foreseeable future.

The company is strategically maintaining a lower payout ratio compared to its historical 100% payout ratio. This decision is driven by a focus on cash flow optimization and deleveraging.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.