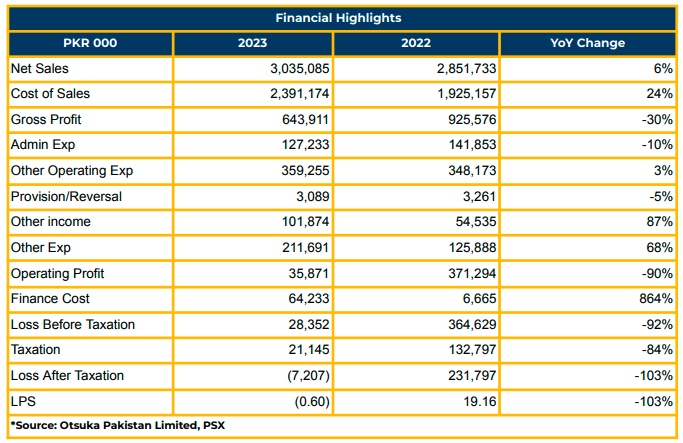

In the fiscal year 2023, OTSU experienced a significant setback, reporting a loss of PKR 7.2 million (Loss per Share: PKR 0.60), marking a steep decline of 103% compared to the previous year’s profitability of PKR 232 million (Earnings per Share: PKR 19.16).

During the same period, both gross profit and operating profit plummeted by 30% and 90% respectively. Despite these challenges, the company managed to achieve a modest 6% increase in net sales, reaching PKR 3.04 billion.The Company also witnessed a 24% rise in the cost of sales in FY23.

Segment-wise sales for OTSU displayed varied trends, with IV sales surging by 54%, followed by CN (34%), MD (8%), and TD (5%). OTSU also witnessed an uptick in exports (PKR 71.13 million), especially the exports of the Neutraceutical products segment to Afghanistan.

Provisions made by the company reduced by 5% to PKR 3.1 million in FY23, compared to PKR 3.3 million in the previous year. However, the finance cost experienced a staggering spike, increasing to PKR 64.2 million in FY23 from PKR 6.67 million in the same period of the previous year.

On the tax front, the company saw a significant decline of 84% in FY23, with taxes totaling PKR 21 million, down from PKR 133 million in the previous fiscal year. The company received PKR 43 million in sales tax refunds, with an additional PKR 47 million refunds still in progress.

In a bid to adapt and innovate, OTSU introduced new products in FY23, such as the ORTie product, receiving positive feedback from the market. Additionally, the company launched Amino Acids in plastic bottles, enhancing Good Manufacturing Practices (GMP) and product quality. Notably, OTSU secured approval for fifteen products from DRAP and is gearing up to introduce two new products in the early months of FY24.

Going forward, OTSU management expects to continue facing economic challenges, including higher inflation and uncertainties in exchange rates. Due to inflationary pressures and increased costs, OTSU has submitted requests to DRAP for price increases on nine products.

Pursuing product diversification, the company is set to launch a series of products through a partnership in Germany. Furthermore, the company intends to renovate Line 1 and Line 3 while launching value-added products in the coming years. Furthermore, the introduction of two new nutraceutical products is on the horizon.

Important Disclosures

Disclaimer:This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.