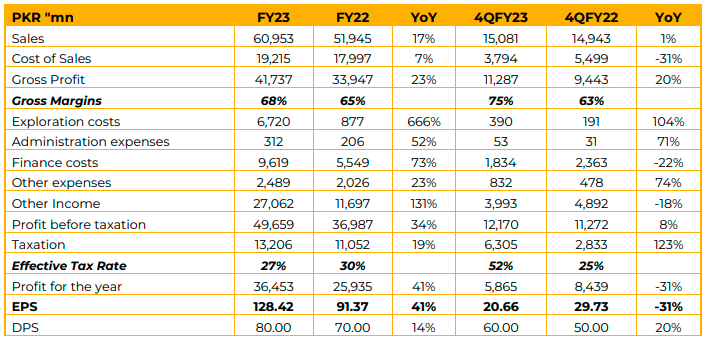

In FY23, the company achieved an impressive PAT of PKR 36.4bn (EPS: PKR128.42/sh), marking a significant upside of 40.55% YoY compared to PKR 25.9bn (EPS: PKR91.37/sh) in SPLY. Similarly, on a consolidated basis, the company achieved a noteworthy profit after tax of PKR 37.3bn (EPS: PKR131.29/sh) against the PAT of PKR26.8bn (EPS: PKR94.28/sh) in SPLY.

The significant increase in profitability can be ascribed to the positive impact of the Rupee/US$ exchange rate on oil and gas prices, coupled with gains resulting from favorable currency exchange rates on financial assets, along with augmented income generated from bank deposits due to favorable interest rates.

The company mainly focused on exploration and development throughout the year. The exploration expenses, totaling PKR6.72 billion, covered the drilling of two dry wells and seismic acquisition/processing. Moreover, the drilled three developed wells and two exploratory wells, demonstrating its dedication to innovation and advancement, despite the challenges.

The management highlighted that the investments in seismic data have led to significant advancements. It completed 3D Seismic data acquisition at Hisal and Pindori blocks, with ongoing data processing, showcasing our commitment to utilizing technology for informed decisions.

The Company is currently acquiring seismic data in the Nareli Block and plan to expand to Langrial, North Dhurnal, and Turkwal blocks to improve prospects.

Tolanj West-2, a successfully drilled well, has tested three formations and is now in production. It currently yields approximately 18 million cubic feet of gas per day and around 19 barrels of oil per day.

At Tal block an exploratory well Razgir has been approved by the Joint Venture Partners and it is expected to start in 1QFY24.

In FY23, production of crude oil and gas were down by by 9% YoY and 8% YoY, respectively. The production of LPG was also lower by 4% YoY. The decline is largely attributed to natural depletion of reservoirs. However, the management is optimistic to enhance production efficiency and that will remain to be a key part of company’s strategy.

Looking ahead to the FY24, the management is committed towards excellence. The company also plans to start two exploratory and six development wells, with a significant investment to grow its reserve base.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose