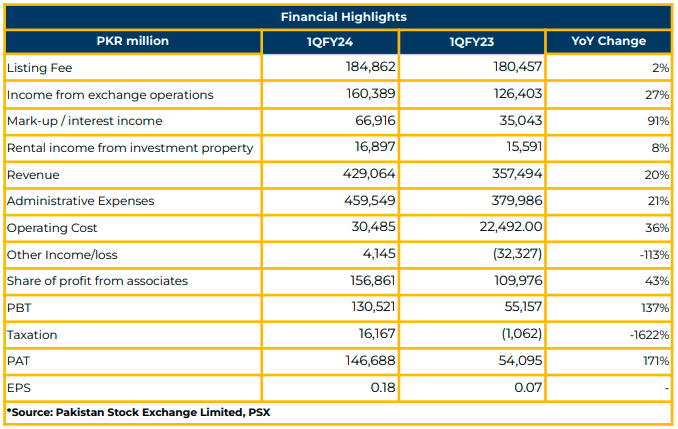

In the 1QFY24, Pakistan Stock Exchange Limited achieved a net profit of PKR 146.69 million (EPS: PKR 0.18), marking a significant increase of 171% YoY from PKR 54.09 million (EPS: PKR 0.07) in the SPLY. This remarkable growth was attributed to effective cost management strategies and prudent treasury management practices employed during FY23 and 1QFY24.

The boost in operating revenue (PKR 345 million) was primarily due to enhanced revenues from a higher initial listing fee, which increased by PKR 14 million, and trading and regulatory fees, which rose by PKR 21 million.

These increments were driven by higher Average Daily Trading Values (ADTV), reaching PKR 14.8 billion in 1QFY24. Additionally, other operating revenues of the company surged by 66% YoY to PKR 84 million, fueled by increased mark-up income and rental income of PKR 32 million and PKR 1 million, respectively, in 1QFY24.

However, the company faced a 21% YoY increase in expenses, amounting to PKR 459.55 million, primarily due to higher inflation. Despite this, PSX managed to reduce the net exchange loss by PKR 36 million, and the share of profit from associated companies (CDC and NCCPL) increased by PKR 48 million in 1QFY24.

In FY23, PSX experienced a 5% decline in operating revenue, totaling PKR 1.2 billion. The rise in annual listing fee (PKR 23 million) and initial listing fee (PKR 9 million) and non-trading income (PKR 13 million) was offset by lower Average Daily Trading Value (PKR 10.1 billion) and a reduction in trading and regulatory fees (PKR 108 million). Consequently, pretax and after-tax profitability decreased by 46% YoY and 45% YoY to PKR 250 million and PKR 220 million, respectively, in FY23. Rental income saw growth due to the leasing of vacant premises and revised rent agreements, resulting in an increase of PKR 8 million during FY23 and PKR 1 million in 1QFY24.

PSX introduced a Golden Handshake policy for non-management staff, leading to an annual saving of PKR 2.5 million. Additionally, the company facilitated investors by launching a WhatsApp service and simplifying investments through the Saulat account.

Going forward, the management plans to focus on continued diversification and data enhancement. However, challenges might arise due to higher capital expenditures on IT developments and maintenance, potentially impacting cash flow temporarily. Data vending is the key focus of the Company as an area of growth.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.