Chase Research:

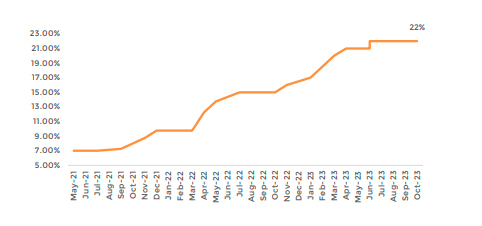

The Monetary Policy Committee (MPC) decided to keep the policy rate at 22 percent. Headline inflation rose in September 2023 as expected, however, it is expected to decline in October onwards, followed by positive agriculture outlook. The MPC noted developments, including positive Kharif crop estimates, a reduced current account deficit in August and September, improved fiscal consolidation, and better inflation expectations. However, global oil price volatility and Middle East conflicts add uncertainty to the outlook.

The Committee acknowledged potential risks to FY24 inflation and the current account due to recent oil price volatility and upcoming gas tariff increases in November 2023. However, they also highlighted mitigating factors such as targeted fiscal consolidation in Q1, enhanced market availability of essential commodities, and the alignment of interbank and open market exchange rates.

In 1QFY24, fiscal deficit decreased from 1% to 0.9% of GDP, and the primary balance showed a surplus of 0.4%, up from 0.2%. Revenue witnessed a 24.9% growth over the same period last year. Broad money growth slowed to 12.9% in September end, primarily due to a decrease in credit to the private sector. The MPC also foresees a significant decline in inflation in October due to lower fuel prices, easing of major food commodity costs, and a favorable base effect. Nevertheless, the recent volatility in global oil prices and the second-round effects of substantial gas tariff increases pose some inflationary risks. The MPC emphasized the importance of continued fiscal prudence to maintain a downward trajectory for inflation.

Overall, the MPC anticipates inflation to decrease in the second half of the year, despite some short-term increases. They stress the importance of fiscal consolidation, supply-side reforms, and a tight monetary policy to achieve price stability and sustainable economic growth.

Analyst Briefing Post MPS Announcement:

Following the announcement of the Monetary Policy, the SBP Governor conducted an analyst briefing, shedding light on several key aspects. Firstly, the decision to maintain unchanged interest rates was driven by the objective of keeping real interest rates in positive territory, in line with

twelve-month forward inflation expectations.

Additionally, M2 growth has reduced during the period mainly due to moderation in NDA. Currency in Circulation also came down during the

noted period.

Regarding external financing, the Governor provided insight into the Gross Repayments of USD 24.5 billion in FY24, with USD 4.3 billion already repaid and USD 12.3 billion set to be rolled over. This leaves a net repayment of USD 5.5 billion for the remainder of the year, which the SBP is fully prepared to meet as the obligations fall due.

The Governor highlighted that the recent surge in commodity prices, particularly rising oil prices, has been factored into their inflation assumptions. The decision to maintain unchanged interest rates takes into account this forward-looking inflation outlook.

Governor disclosed that the projected Current Account Deficit FY24 remains unchanged at 0.5% to 1.5% of GDP. Moreover, the FX reserves target is also in line with projection of USD 10.4 billion for FY24.

Outlook:

Considering the inflation and stable currency outlook provided by SBP, barring any unforeseen external shocks, it’s reasonable to characterize the

current interest rate of 22% as the peak rate. We can anticipate a reduction in interest rates during the fourth quarter of FY24 as inflation reduces.

Important Disclosures:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose