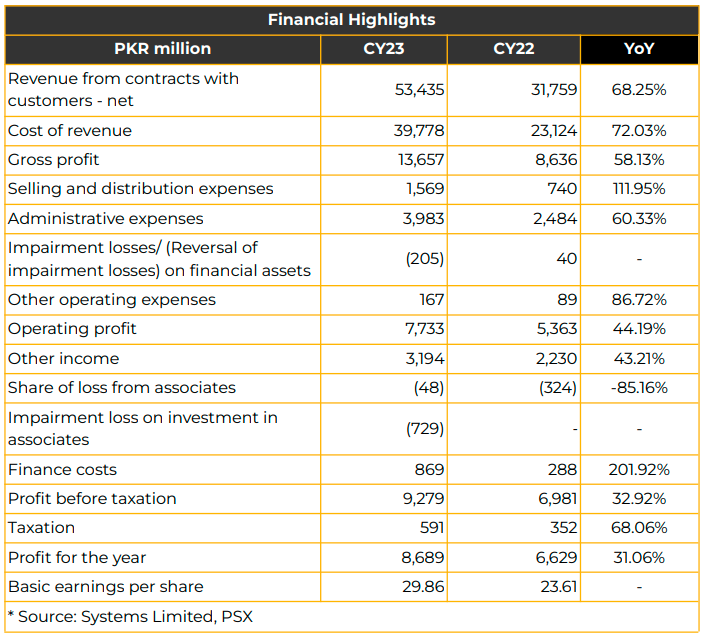

On a consolidated basis, SYS experienced a remarkable surge in profitability, reaching PKR 8.69 billion (EPS: PKR 29.86), showcasing an impressive 31.06% YoY increase compared to PKR 6.63 billion (EPS: PKR 23.61) in the same period last year.

The company’s total revenue saw a notable 68.25% YoY increase, reaching PKR 53.44 billion, compared to PKR 31.76 billion in the previous year. This increase reflects a normalized growth rate of 85% after adjusting for the one-time sale of the CLOS product license in 2022.

In CY22, SYS recorded a significant one-time revenue from the sale of the CLOS product license, which brought in an upfront payment of $8 million and subsequent royalties of approximately $7 million over five years, recognized at present value. When considering the one-off revenue from the CLOS product license sale in CY22, the reported growth for 2023 stands at 68%.

Additionally, a cost of $15 million was adjusted against the revalued intangible assets during acquisition, balancing the profit and loss statement. Revenue in USD terms surged by 36.03% YoY, reaching USD 190.79 million in CY23.

Management reported that the operating profit showed a significant growth of 47.06%, amounting to PKR 7.89 billion in CY23. However, this reported figure includes a one-off impairment loss related to the measurement of the investment in Jomo Technologies (Pvt) Limited,

amounting to Rs. 154 million. As a result, the reported growth is adjusted to 44.19%. In CY22, the management acquired a 9% stake in Jomo Technologies (Pvt) Limited, a rapidly growing fashion e-commerce brand in Pakistan.

Selling and distribution expenses grew by 111.95%, while administrative expenses saw a substantial 60.33% increase in CY23, partially due to the addition of new subsidiaries.

On an unconsolidated level, the company’s overall profitability reached PKR 8.56 billion, compared to PKR 6.30 billion in the same period last year, reflecting an 36% YoY growth in PKR terms and 26% growth in USD terms in 1HCY23. The impressive revenue growth was attributed to the expansion of IT services while profitability grew due to the increased demand and expansion across all geographical regions and industry verticals.

In terms of revenue distribution by geography, the Middle East and Africa accounted for 55%, followed by North America (23%), Pakistan (16%), Europe (4%), and Asia Pacific (2%).

Gross profit margin and operating profit margins stood at 26% and 14% respectively during the same period. However, higher inflation exerted pressure on the company’s margins. Lower gross profit margins were attributed to inflationary adjustments, increased energy prices, devaluation, and high amortization costs related to intellectual property (CMB), WHT on payments from subsidiaries and net addition of approximately 1,200 resources since 2022.

Operating margins declined due to the addition of subsidiaries and NDC, withholding tax on payments from subsidiaries, one-off adjustment of investment in JOMO, and higher IFRS 9 adjustments on receivables. Of the other income, 71%, which amounts to Rs 2.3 billion, stems from exchange gains. The rest arises from a one-time gain from Jugnu and asset disposals.

The taxation increased by 68% YoY due to the Super tax, higher WHT, and tax on export revenue coupled with the addition of corporate tax in KSA.

The share of the top 20% clients and top 10% clients in revenue slightly increased to 49% and 36% in CY23. The number of active clients stands at 236 clients with a revenue contribution of more than USD 100,000.

Moreover, the company’s revenue currency mix includes 95% in foreign currency and 5% in local currency. On the cost side, 60% of expenses are incurred in local currency and 40% in foreign currency. 85% of total revenue comes from exports. Management expects the domestic revenue to stay between 15%-20% The total number of employees increased to over 7,000, with 86.28% being Pakistani nationals. An addition of 2000-2200 resources is expected in CY24.

The revenue distribution by vertical is as follows: 22% from BFSI, 14% from Telco, 14% from Technology, 11% from Retail & CPG, 10% from the public sector, and 15% from other sectors.

Going forward, Systems Limited aims to bolster its presence in the UAE and KSA markets with the objective of doubling its revenue. Management’s

strategic focus revolves around reinvestments and the expansion of exports in the foreseeable future. However, the company does not plan to embark on aggressive investment initiatives in the immediate term. While management anticipates that tech parks in Pakistan will offer new opportunities, they recognize the necessity to further explore this avenue. Additionally, margins are expected to face continued pressure in the

1QCY24.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.