Key Takeway

Bank of Punjab Poised for Transition to Islamic Banking by CY26:

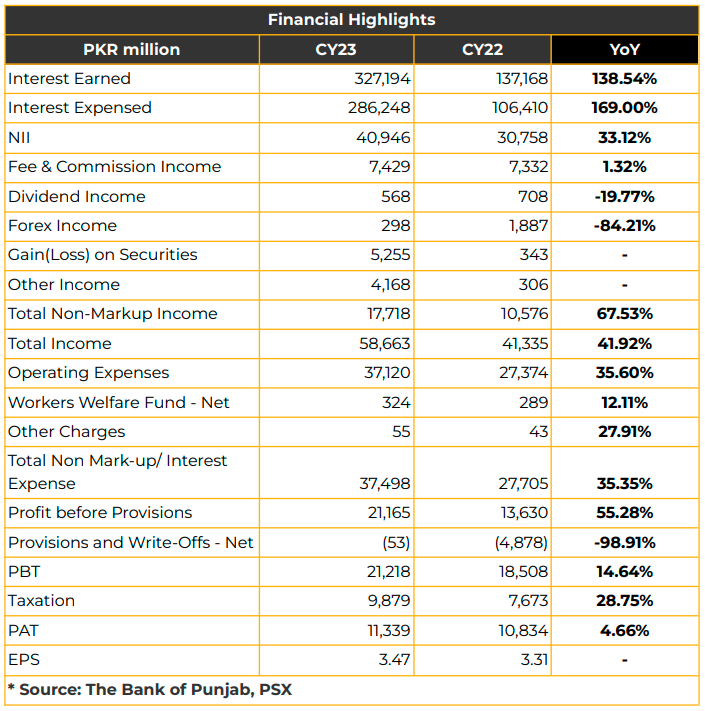

In CY23, the bank recorded an unconsolidated profit of PKR 11.34 billion (EPS: PKR 3.47), marking a 4.66% YoY increase compared to PKR 10.83 billion (EPS: PKR 3.31) in SPLY. Profit Before Tax (PBT) stood at PKR 21.22 billion, notably improved from PKR 18.51 billion in the corresponding period.

The bank’s Net Interest Income (NII) surged impressively by 33% to PKR 40.95 billion in CY23, compared to PKR 30.76 billion in CY22. Fee and commission income increased by 1.32% to PKR 7.43 billion in CY23, compared to PKR 7.33 billion in SPLY.

Dividend income experienced a 20% YoY decrease, reaching PKR 568 million (compared to PKR 708 million in CY22), while forex income plummeted by 84% to PKR 298 million (from PKR 1.89 billion) in CY23. On a positive note, total non-markup income saw a significant boost, rising by 68% YoY to PKR 17.72 billion, primarily fueled by a substantial gain on securities amounting to PKR 5.26 billion and additional income of PKR 4.17 billion.

The bank earned PKR 327.19 billion in markup against markup expenses of PKR 286.25 billion in CY23. Operating expenses also increased by 36% to PKR 37.12 billion in CY23, primarily due to rising inflation and the bank’s branch expansion.

Additionally, the bank’s net provisions significantly dropped with a provision expense of PKR 53 million compared to PKR 4.88 billion in SPLY, reducing the burden on the bank’s profits. Tax payments also increased by 29% to PKR 9.88 billion during the period under review. The total assets of BOP were reported at PKR 2.22 trillion, with a CAGR of 5%, in CY23.

On the other hand, the share of the fixed investment portfolio was reduced significantly by the bank, with PIB floaters constituting 84% and MTBs and fixed PIBs constituting 16% of the total investment. Approximately half of the PIBs are expected to mature this financial year, while the remaining are to mature by CY25. The share of floating PIBs is expected to improve to 90% by CY25, with 10% in MTBs and fixed PIBs in the portfolio.

BOP experienced growth in deposits (24% YoY) to PKR 1.52 trillion, while gross advances remained high (34% YoY) at PKR 850 billion. The bank currently holds a 5.2% market share in terms of deposits.

The bank is reducing its share of government deposits and expects to improve margins by attracting more private deposits. Due to seasonality, agri deposits are likely to vary over time.

Investments and lending to financial institutions significantly improved by 49% YoY to PKR 1.01 trillion in CY23 compared to PKR 708.1 billion in SPLY. Management reported that the majority of fixed-income investments have matured and are likely to improve margins in 1QCY24.

The IFRS-9 implementation will be witnessed in the first quarter of this calendar year.

Non-performing loans (NPLs) were reduced to PKR 50.88 billion in CY23 from PKR 51.56 billion. The Cost-to-Income ratio stood at 63.92% YTD, while Return on Equity (ROE) was reported at 15.55%. The Bank’s Capital Adequacy Ratio surged to 18.37%, a substantial increase from the 13.57% reported in CY23, surpassing the SBP’s mandated level of 11.50%.

This notable improvement is attributed to the prudent inclusion of advance subscription funds earmarked for future Term Finance Certificates (TFCs), classified as ADT-I & ADT-II capital, without which the CAR in CY22 would have remained at 13.11%.

The CASA (Current Account Savings Account) ratio decreased to 62% from 65% in SPLY. Book value per share improved to PKR 24.12 in CY23 from PKR 22.65 in SPLY.

Management also reported a leverage ratio of 3.38% in CY23 against 3.46% in CY22, in line with the SBP required level of 3%.

BOP operates 655 conventional, 160 Islamic, and 73 IB Windows, including 16 sub-branches, across 407 cities in Pakistan. Management indicated that the Punjab branches are relatively in loss due to the opening of branches in remote areas to ensure financial inclusion of all segments in Pakistan compared to branches in other provinces.

The branch network breakup in different provinces is as follows: 603 (Punjab), 84 (Sindh), 10 (Azad Kashmir), 15 (Balochistan), 23 (Federal), 10 (GB), and 70 branches in KPK.

Going forward, the bank plans to open new branches, crossing 900 branches in CY24. Management plans to achieve a target of 1,000 branches in a couple of years with conversion to Islamic banking by CY26.

The bank’s management also noted the potential reduction of the policy rate is beneficial for the bank because of the bank’s focus on Islamic savings, current accounts, and other income. Moreover, the bank expects the policy rate to be reduced going forward.

plans to further reduce fixed-income investments and the share of government deposits. Furthermore, the bank plans to digitize operations with

more focus on floating income, targeting SME and agri segments, urban branches, and expansion outside of Punjab.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject to this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.