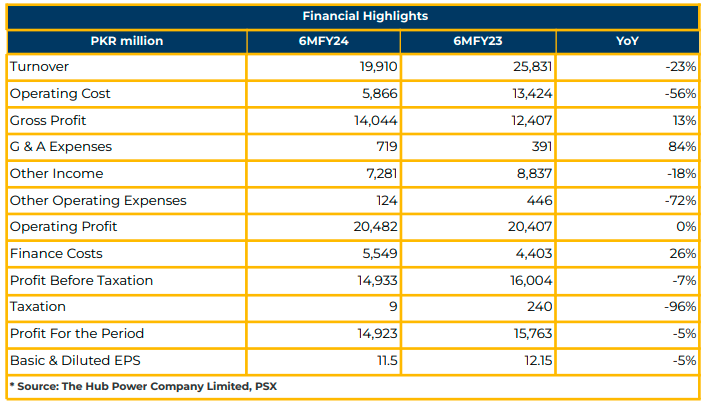

In FY1H2024, The Hub Power Company Limited (HUBC) recorded an unconsolidated net profit of PKR 14.92 billion (EPS: PKR 11.5), reflecting a 5% year-on-year decrease from PKR 15.76 billion (EPS: PKR 12.15) in the corresponding period of the previous year (SPLY). The decline in profitability was attributed to elevated finance costs arising from higher interest rates and the absence of load factor in the current period.

The reported load factors are as follows: Hub – 0%, Narowal – 12%, Laraib – 52%, CPHGC – 7%, TEL – 88%, and TNPTL – 76% in 1HFY24.

The company’s turnover witnessed a 23% year-on-year decrease, amounting to PKR 19.10 billion in 1HFY24, compared to PKR 25.83 billion in the corresponding period of the prior year.

Gross profit experienced a 13% year-on-year increase, reaching PKR 14.04 billion in 1HFY24, compared to PKR 12.41 billion in the preceding year.

HUBC’s operating cost significantly decreased by 56% year-on-year to PKR 5.87 billion in 1HFY24, as opposed to PKR 13.42 billion in SPLY. However, general and administrative expenses rose by 84% to PKR 718.73 million, while finance costs increased by 26% year-on-year to PKR 5.55 billion, compared to PKR 4.40 billion in the previous year.

The power generation fuel mix comprises RFO (42%), Imported Coal (37%), Thar Coal (18%), and Hydel (2%), contributing to a total power generation of 3,581MW. The mining capacity stands at 7.6 MPTA, and E&P is at 10.7 MMBOE.

HUBC received a share of USD 32 million from the USD 70 million distributed by CPHGC as a dividend. Furthermore, the first-fill arbitration decision favored the company, as communicated by management.

Additionally, the management disclosed that HUBC has entered into a power purchase agreement with HBL for the acquisition of 9.5% shares of Sindh Engro Coal Mining Company Limited (SECMC). The Company plans to finance this with internal resources.

Significantly, regarding the repayment of an outstanding loan amounting to PKR 17.2 billion, the management mentioned that the Company repaid PKR 2.3 billion due to the dividend income received from CPHGC and COD of TEL and TNPTL. The Company initially obtained this loan for investment in Thar coal and imported coal projects.

In 1HFY24, all the plants operated at nearly 100% availability. The reported availability figures were: Hub (91%), Narowal (98%), Laraib (99%), CPHGC (100%), TEL (100%), and TNPTL (100%).

Concerning the dividend policy, the management emphasized that the Company’s policy is to distribute dividends unless there are expansion plans. The management shared that the Company is in the final stages for KE’s 200MW wind/solar hybrid project and for 150MW+120MW of Sindh Solar Energy Project for power offtake by KE. Additionally, HUBC successfully signed an MoU with KE for the potential conversion of two units of RFO-fired Hub Power Plant to Thar coal after the expiry of the existing PPA in March 2027. The CPPA agreements of the Norowal and Laraib plants are due to expire in 2036 and 2027 respectively.

Looking ahead, HUBC plans to explore opportunities in Battery Energy Storage Solutions (BESS) and Electric Vehicles. The lower prices of EV raw materials due to increased competition is expected to benefit large energy players in Pakistan in this regard, as highlighted by management.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.