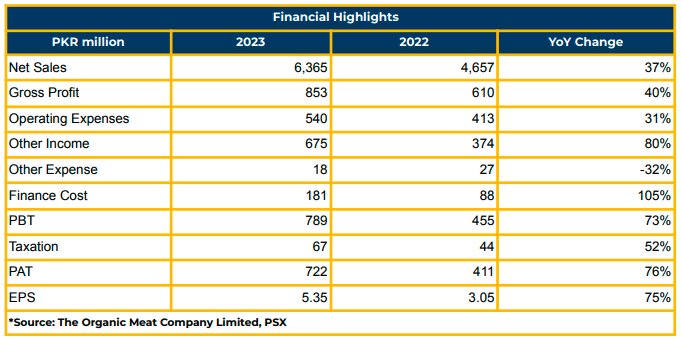

In FY23, TOMCL reported a profit of PKR 722.19 million (EPS: PKR 5.35), marking a significant 76% increase compared to the previous year’s profitability of PKR 411.41 million (EPS: PKR 3.05).

Moreover, the company’s topline surged by 37% YoY to PKR 6.365 billion in FY23. The revenue breakdown by products revealed that Meat constituted 88%, frozen offals 10%, and pet chews 2%. During the same period, gross profit rose by 40% to PKR 852.89 million in FY23.

The cost of sales experienced a notable uptick to PKR 894.56/bag due to higher procurement costs and depreciation charges. Procuring meat and offals accounted for 93% of the overall cost component.

Similarly, selling and distribution expenses increased by 41% during this period, but admin expenses rose by 39% in FY23. Finance costs increased to PKR 181 million from PKR 88 million, balanced by lower provisioning on export rebate receivable. Other income surged by 80% due to foreign exchange gains in FY23.

In terms of product mix, meat constituted 88.66%, offals 10.93%, and pet chews 0.41%. The sales mix by volume consisted of chilled meat (75%), frozen meat (13%), frozen offals (11%), chilled vacuum-packed meat (1.21%), and pet chews (0.41%) in FY23.

The company also ventured into private labelling, expanding successfully in KSA and now exploring opportunities in the UAE market.

Export figures for FY23 stood at 6,163 MT, a 2% decrease from the previous year. Fresh chilled meat and frozen offal exports dropped by 6% and 18% YoY due to prolonged Covid-related lockdowns.

However, frozen meat exports increased by 66%, and pet chews saw a remarkable growth of 502% YoY, penetrating new markets in North and South America.

Despite an overall decline in average prices by 2.78% during FY23, the company’s export revenue increased by 36.35%, benefiting from a 38.56% devaluation against the USD.

The UAE remained the largest export market (56%), followed by KSA (23%), Vietnam (7%), Oman (4%), Hong Kong (2%), USA (2%), and CIS (1%).

To overcome the export ban of fresh chilled meat via sea to the UAE market, the company opted for exporting value-added MAP vacuum-packed fresh chilled meat via sea to the UAE as an export substitution option.

The company is increasing its focus on KSA due to the advantageous safe credit. Additionally, TOMCL explored opportunities in Canada and Uzbekistan for frozen meat and pet chews, respectively, in FY23. Approvals were secured from China to export cooked beef.

Going forward, the management has outlined a medium-to-long-term plan, aiming to expand product offerings in pet chews and fast foods businesses due to higher margins.

Negotiations are underway with the Sindh government for the creation of FMD-free compartments. The company plans to introduce offal processing at MSMH. By reducing reliance on the UAE market, KSA stands out as an ideal market for the company. Expansion in the sheep and beef casings market in the UAE and EU also aligns with this long-term strategy. Additionally, the Company aims to achieve a zero-debt status in next two-three years and reach a net sales target of PKR 10 billion next year.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.