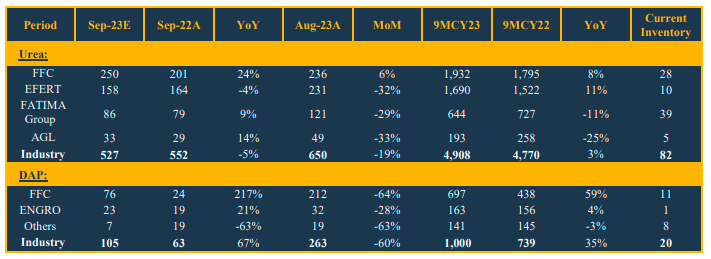

Pakistan Urea sales in Sep’23 are expected to clock in at 627K tons, down by 5% YoY compared to 552K tons in Sep’22. Similarly, Urea sales are expected to be down by 19% MoM, compared to 650K tons in Aug’23, due to seasonality factor.

Cumulatively, in 9MCY23 urea sales are expected to clock in at 4,908K tons, up by 3% YoY compared to 4,770k tons in 9MCY22. Fauji group is likely to record offtakes of 250K tons followed by 158k tons of Engro Fertilizers, 86K tons of Fatima Group (FATIMA) and Agritech (AGL) of 33K tons in Sep’23, respectively.

This will take closing inventory of Urea to 82K tons in Sep’23. Whereas, total DAP sales are anticipated to clock in at around 105K tons, witnessing a substantial upside of 67% YoY in Sep’23. However, DAP sales will likely to down by 60% MoM in Sep’23. The YoY increase in DAP sales is likely attributed to slow down in int’l prices along with low base affect.

As per our estimates, FFC group will likely to record DAP sales of 76K tons followed by sales of EFERT to 23K tons, respectively.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under

no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.