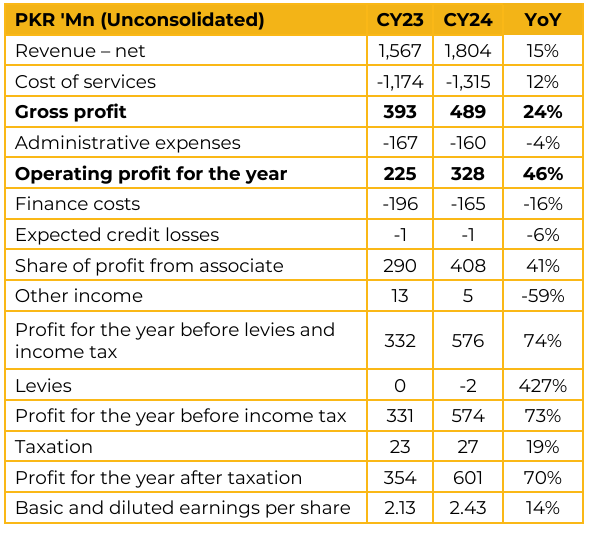

Secure Logistics Group Limited (SLGL) reported earnings per share of PKR 2.43 for CY24, compared to PKR 2.13 in CY23. The merger of Secure Logistics Group (SLG) with its subsidiary Trax Online was legally sanctioned by the Islamabad High Court on May 5, 2025.

Management emphasized that the merger has created a unique blend of asset-heavy and asset-light operations with complementary business lines and no overlaps. Identified synergies amounting to PKR 400 million are under execution, with expected realization by April 2026. Legacy SLG contributed its commercial fleet, diversified cash flows from traditional logistics, IoT operations, and security services. Trax contributed e-commerce last-mile logistics, warehousing, and a nationwide tech-enabled platform.

Together, the group now operates through five legal entities, including SLG (transportation), LogiServe (tech platform, IoT, NBFC), and Sky Guards (security). The footprint spans 200 offices across 60 cities by year-end 2025, serving 300+ B2B clients and 9,000+ B2C clients. Three warehouses are being converted into full-scale logistics hubs, while fleet size is projected to reach 500–600 vehicles, with emphasis on medium-haul and last-mile segments.

TIIR-certified trial runs were completed with cross-border shipments to Tashkent, with plans to allocate 20–25% of fleet capacity to regional markets. LogiServe, a subsidiary, obtained its NBFC license on August 19, 2025, with a commercial launch planned for October 1. Operating under the Islamabad Special Technology Zone, LogiServe benefits from an eight-year corporate tax holiday. The platform aims to resolve Pakistan’s e-commerce liquidity challenges, where 93% of transactions rely on cash-on-delivery. The model enables merchants to receive instant payments against delivered shipments, financed through short-term working capital lines sourced from banks and HNWIs. A pilot launched in February 2025 processed weekly credit lines of PKR 70 million across 60–70 vendors. Management positioned the NBFC as a significant “value multiplier” and projected it will account for 15% of operating profit by 2029.

Post-merger integration is nearly complete. The group plans PKR 100–120 million in CAPEX for warehouse conversions this year, alongside procurement of 100 Suzuki Ravi vehicles to enhance last mile delivery. Regional market entry into Uzbekistan and Kazakhstan is expected by end-2025. SLGL is also piloting EV motorcycles and has installed charging infrastructure in Lahore. The company has developed an in-house proprietary IT suite covering logistics, IoT, Fintech, and merchant integration. SAP ERP implementation will begin across legacy SLG operations. Mobile platforms, including the recently launched “Pulse” app, are positioned to enhance client experience.

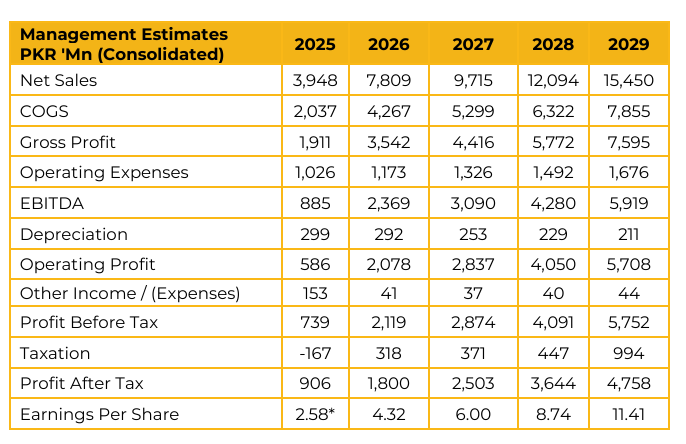

Going forward, management forecasts consolidated revenue to expand from PKR 2.5 billion in 2024 to PKR 15 billion in 2029. For 2026, PAT is projected at PKR 1.8 billion (EPS PKR 4.32). Operating profit mix will shift towards e-commerce and Fintech (45% in 2026, 70% in 2029), highlighting the transformation into a tech-enabled logistics financial ecosystem. Net margins are expected to stabilize in the 20 24% range.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.