Lucky Cement Limited (LUCK) reported consolidated post-split earnings per share of PKR 52.53 (standalone: PKR 22.59) for FY25. During the year, Lucky Cement executed a 5:1 stock split to broaden accessibility for retail investors. Overall volumetric dispatches increased by 8% in FY25, driven primarily by strong export sales.

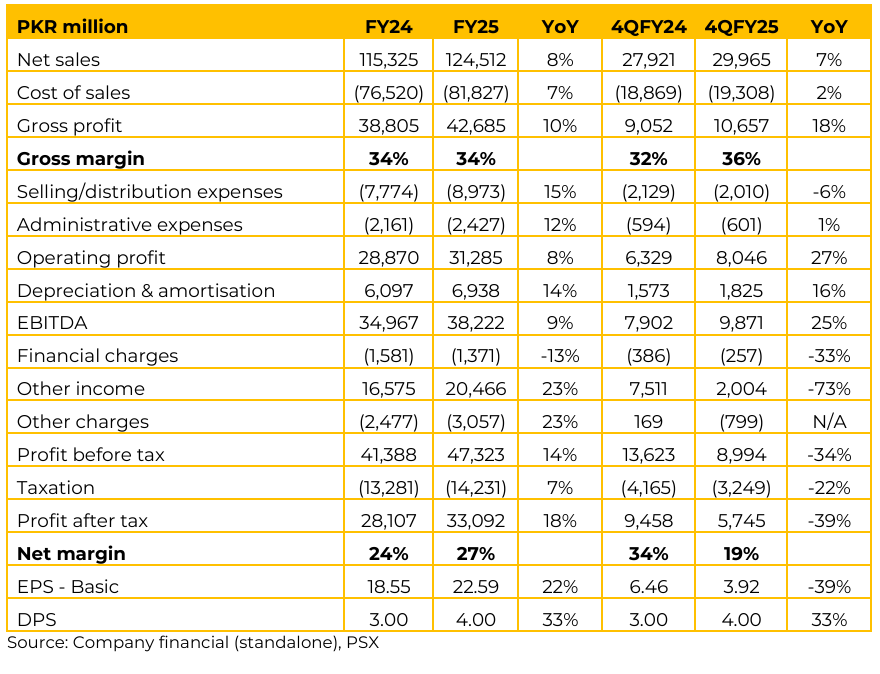

Domestic volumes fell 5.5% to 5.9 million tons, though the company maintained its market share at 16%, broadly unchanged from last year. Export volumes rose sharply by 53% to 3.4 million tons, lifting Lucky’s export market share to 36.6% of total exports from Pakistan. Gross profit increased from PKR 38.8 billion to PKR 42.7 billion, supported by stable coal prices, favorable exchange rates, and the commissioning of the 28.8 MW wind project at the Karachi plant in October 2024.

This project only contributed nine months to FY25 results, with greater impact expected in FY26. Other income rose significantly on account of surplus cash held for future strategic investments, expansions, and contingency reserves. The management noted that they will maintain significant cash surplus for strategic and contingency purposes. North and South plants are equipped with renewable plants and Karachi meeting 65% of its needs from renewables.

To optimize usage, Battery Energy Storage Systems (BESS) have been installed, including a 20.7 MW unit at Karachi completed post June 2025. These systems smooth surges and shortfalls, enabling greater reliance on renewables without adding capacity. Iraq plant is operating at around 95% capacity and planning expansion by next year, while the Congo plant runs at 84–85% utilization and is profitable.

Management expects both regions to sustain or improve utilization levels in FY26. In mining, Lucky’s joint venture NRL is advancing copper and gold exploration in Chaghi, Balochistan. Scout drilling results have been “very encouraging,” justifying continued exploration though not yet an economic discovery. An MRE (Mining Resource Estimate) is still 2.5–3 years away, with mining construction another 2–2.5 years beyond that. Management guided that any bottom-line impact would take six to seven years. Near-term capital spend will remain modest, though the project could require significant investment if proven viable.

Management confirmed the group’s participation in the consortium evaluating investment in Pakistan International Airlines (PIA), alongside HUBCO and Kohat Cement. Due diligence is ongoing, with hopes that this time the transaction structure will be more viable for investors.

Lucky views PIA’s diaspora-driven routes as attractive, provided taxation issues on air travel are addressed. Management’s forecast for FY26 is a conservative 5% growth in combined North and South markets, compared with more optimistic industry estimates of 8–10%. While July–August FY26 numbers indicated 14% growth, the CFO cautioned that this was misleading given the depressed base in June 2025. He further noted that floods are unlikely to generate incremental cement demand, as previous episodes showed only temporary disruption without sustained increases in housing or dam construction activity. On export side, African markets particularly Ghana, Madagascar, and Cameroon have grown in prominence, lifting Africa’s share of the company’s exports to 62%.

Export prices averaged $41/ton for cement and $31/ton for clinker. Management expects export momentum to continue, supported by global supply shortages, such as Egypt’s reduced presence after subsidy withdrawal. Domestically, the company’s average retention price in FY25 was around PKR 15,000 per ton, with the North slightly higher at PKR 16,000 due to royalty structures.

Prices remain broadly at these levels but have been distorted recently by floods and rains. The Karachi plant relies on imported coal from South Africa and Tanzania, averaging around $100/ton (excluding incidentals). The North plant uses 75–80% local coal and 20–25% Afghan coal, costing around PKR 38,000/ton due to transportation. Grid electricity costs are approximately PKR 36/unit, expected to fall toward PKR 33/unit as grid reliance increases. Going forward, the management expressed cautious optimism for FY26.

Lower interest rates and easing inflation should support medium-term cement demand, though a broad-based recovery depends on domestic manufacturing, services, and infrastructure revival. Export volumes are expected to remain strong, buoyed by higher global prices and Lucky’s entrenched positions in African markets.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.