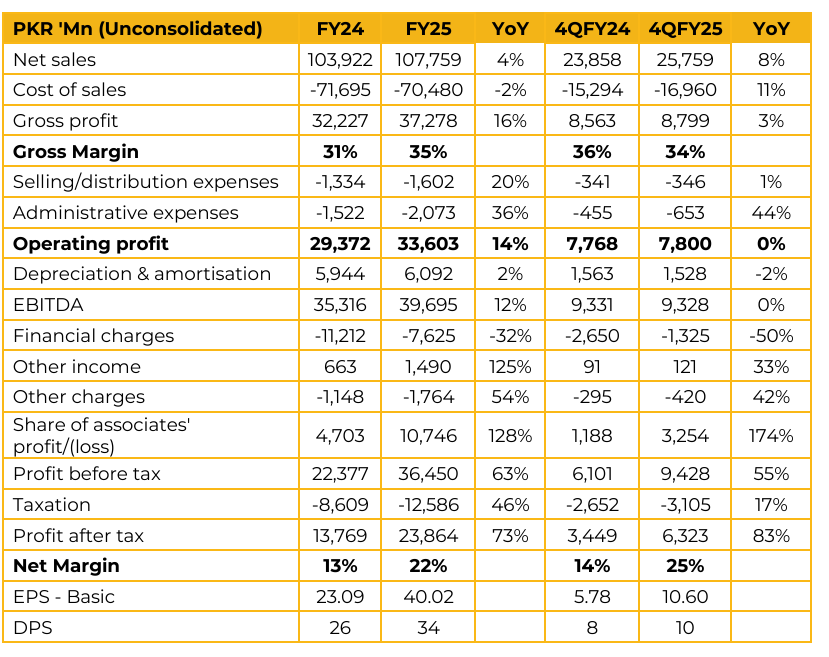

Bestway Cement Limited (BWCL) reported earnings per share of PKR 40.02 for FY25, compared to earnings per share of PKR 23.09 in FY24. Furthermore, in 4QFY25, the company reported earnings per share of PKR 10.60, compared to earnings per share of PKR 5.68 in the same period last year (SPLY). According to management, the cost of solar energy stands at approximately PKR 16 per unit, while waste heat recovery costs around PKR 7 per unit. In comparison, the grid electricity rate is PKR 34 per unit. The company is exploring opportunities to further enhance its renewable energy capacity, although any increase is expected to be marginal. Management anticipates an improvement of around 5% in sales volumes. However, this will be more evident by the end of December.

They remain optimistic about a YoY increase in demand. The company had expressed interest in acquiring Attock Cement but unfortunately did not proceed to the next round of the acquisition process. Currently, the retention rate for local sales is around PKR 15,200 per ton, which is lower compared to last year. This decline is primarily attributed to subdued demand and increased competition.

For FY26, the company expects local retention to remain at similar levels as last year. On the export front, the retention stands at PKR 8,500 per ton, and management expects this to remain stable as well. The gross profit (GP) margin for the year stood at 34%, and the company expects similar margins to be maintained in the current year.

The cost of production ranges between PKR 9,500 to PKR 10,000 per ton, and is expected to stay within this band, depending on plant utilization levels. The company is currently sourcing 60–70% of its coal requirements from local sources, depending on availability, with the remainder primarily being Afghan coal. About 44–45% of the company’s energy needs are met through the grid, while the remaining is fulfilled through internal sources.

The company is not currently exporting via sea, as its plant is primarily located in the northern region of the country. The high inland transportation costs to port cities eliminate the competitive advantage compared to coastal players. As a result, the company is currently exporting mainly to Afghanistan.

The company is exploring options to expand and diversify its business. Several initiatives are currently in the pipeline, and management will provide updates once any developments materialize. Additionally, the company has obtained approval to acquire 50 million shares of UBL, of which it has already acquired 26 million. Management will consider purchasing more shares if favourable opportunities arise in the market, though there are no immediate plans to do so.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.