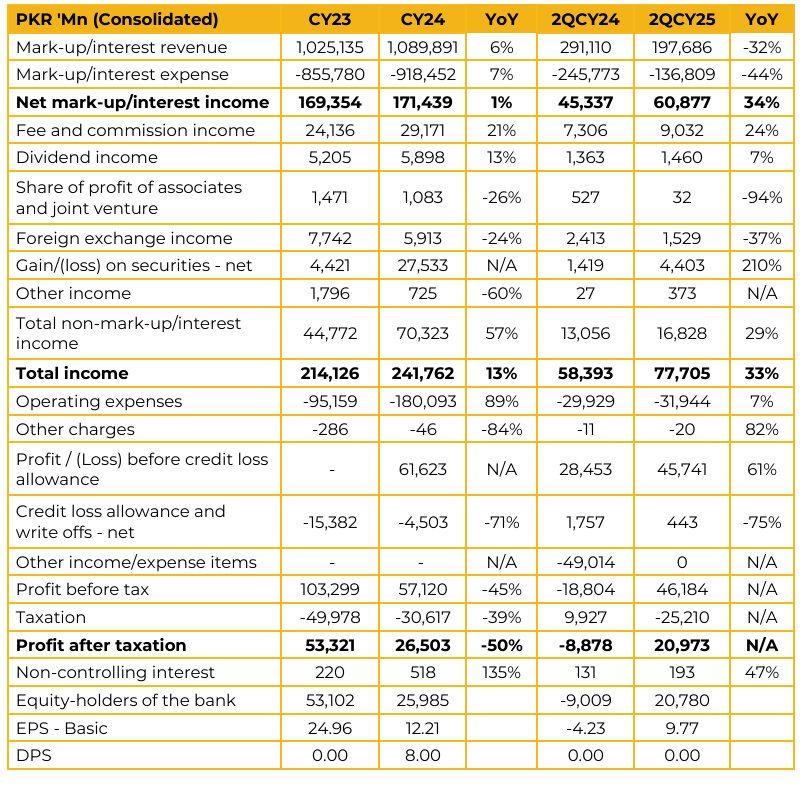

National Bank of Pakistan (NBP) reported consolidated earnings per share of PKR 12.21 for CY24, compared to PKR 24.96 in CY23. Furthermore, in 2QCY25, the company reported EPS of PKR 9.77, compared to loss per share of PKR 4.23 in the same period last year (SPLY).

Management highlighted that PKR 6.9 billion in realized capital gains from FVOCI equity investments, which were previously booked in the profit and loss (P&L) statement, are now routed through Other Comprehensive Income under IFRS 9. Gross advances declined by 5.5% (PKR 91.8bn) CYTD, largely reflecting subdued corporate credit demand, though the bank continues to maintain its leadership in agricultural lending with a portfolio of PKR 120bn.

The investment portfolio has a duration of 2.75 years and an average yield of 13.96%. Repricing of some portfolios is expected in the second half of the year Within the fixed-income book, fixed-rate PIBs comprised 18.0% with a weighted average maturity of 2.36 years, while floaters made up 53.0% with a weighted average maturity of 4.13 years.

The T-Bill portfolio, representing 28.7% of total holdings, carried a weighted average maturity of 0.38 years. In addition, the bank maintains a well-diversified equity investment portfolio, with capital gains of PKR 1.15bn under FVPL and PKR 6.15bn under FVOCI. NBP is actively involved in both the Eurobond and equity investment markets, considering this a potential upside on earnings and a sustained income source.

The bank’s current account and savings account (CASA) deposits increased to 82.9% during the 1HFY25, up from 79.5% at the end of CY24. The cost of deposits significantly improved to 6.8% in the 1HFY25, compared to 12.2% in FY24. This improvement was mainly due to a decline in the policy rate and the State Bank doing away with minimum deposit rates (MDR) for certain customer categories.

Despite a strong capital adequacy ratio of 27.28% in June 2025 a significant increase from 15.48% in 2019 the ratio saw a 52 basis point decline since December.

This decrease was primarily due to the National Bank of Pakistan (NBP) proactively adopting half of the State Bank’s new guidelines. These guidelines require banks to incorporate market risk into their AFS portfolio valuations, an adjustment that other banks have up to three years to implement. Following a strong performance, NBP resumed dividend payments in 2024, with its payout ratio aligning with broader industry trends.

The bank’s robust capital position provides flexibility for future distributions. While dividends for the current year are anticipated to follow a similar pattern to last year, the ultimate decision remains subject to the board’s discretion. Management commented that it’s too early to assess the impact of recent floods, but the experience from 2022 suggests they did not have a large impact on bank earnings.

While continuing to fulfill its role as the largest public sector government bank, NBP is diversifying its lending portfolio to include agriculture, theme-based lending, and individual loans, which aims to broaden its income streams beyond government transactions.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.