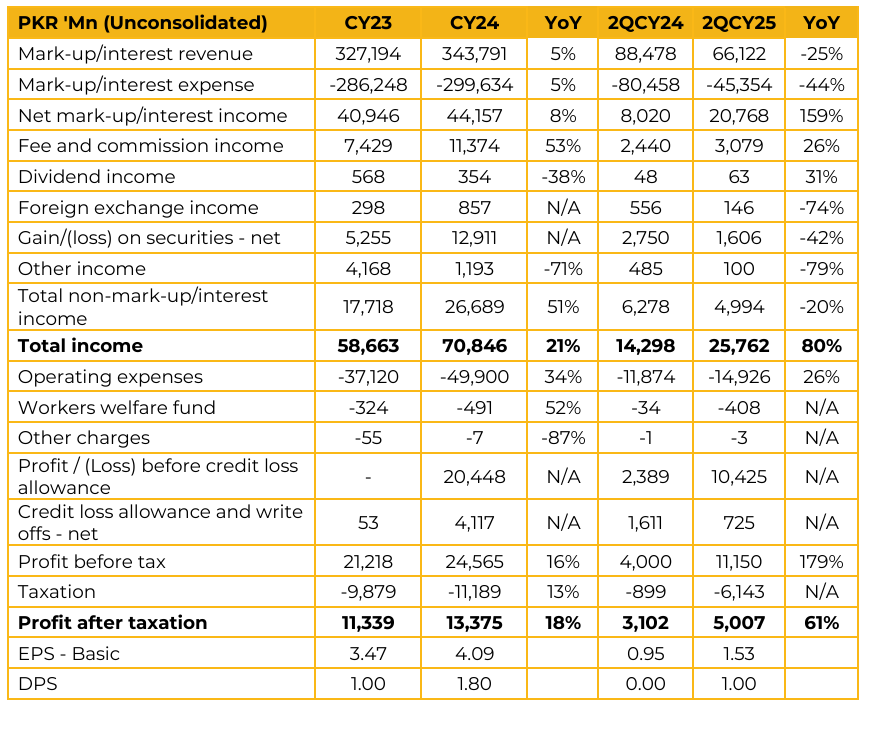

Bank of Punjab (BOP) reported earnings per share of PKR 4.09 for CY24, compared to PKR 3.47 in CY23. Furthermore, in 2QCY25, the company reported earnings per share of PKR 1.53, compared to PKR 0.95 in the same period last year (SPLY). Management stressed that the earnings uplift is structural rather than one-off. Approximately 40% of the Net Interest Income increase stemmed from advances growth and margin expansion, 25% from a 40% improvement in average Current Account balances, 25% from MDR (expected to normalize to 15% over time).

The systematic repricing of term deposits has been pivotal, 64% of TDRs had been repriced by June, rising to 87% by August, delivering 4–5% positive spreads. The Current Account ratio is already at 24% versus a 22% target, the bank is well ahead of plan, with a medium-term goal of reaching the industry’s 33–35% benchmark. Additionally, PKR 6bn in unrealized treasury gains provide earnings optionality. On credit quality, the total loan book stood at PKR 770bn in Aug, with SME/Agri comprising one-third. Of this, 76.6% is protected by government first-loss guarantees, and only 8% is in flood-declared areas, leaving just 6.5% clean.

Overall, only 0.4% of total loans are potentially at risk, which management considers manageable given earnings momentum. Government relief measures (cash grants and concessional financing) are expected to further mitigate exposures. The investment portfolio remains conservatively structured, with 53–55% floating PIBs, 23–24% T-Bills, and 15-16% in fixed PIBs. Portfolio yield is slightly above 12%. Strategically, the bank is targeting PKR 2trn in deposits this year, rising to PKR 2.6trn over three years.

Branch expansion plans include adding 100 outlets to surpass the 1,000 milestone, though the near-term focus is on optimizing network productivity and service quality. On asset quality upside, management noted the portfolio is largely cleaned up but added that a potential legal change allowing public-sector banks to write off principal similar to private peers could unlock sizeable reversals, potentially doubling profitability.

A formal dividend policy has been adopted, with interim payouts to continue and quarterly dividends considered as a future aspiration. Management guided that policy rates could decline by another 100–125bps over the next six months.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.