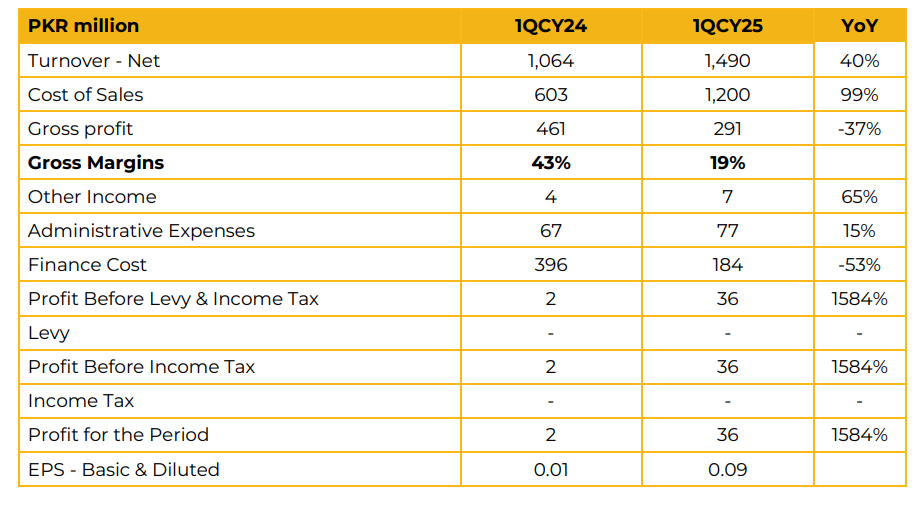

Saif Power Limited reported a net profit of PKR 36.07 million (EPS: PKR 0.09) in 1QCY25, significantly higher than PKR 2.14 million (EPS: PKR 0.01) in 1QCY24. In CY24, SPWL reported revenue of PKR 9.67 billion compared to PKR 19.04 billion in the SPLY. The decline in revenue was attributed to lower plant utilization, which stood at 8.23%, while the plant’s availability factor was higher at 94.2% in CY24 compared to 84.6% in the SPLY.

Management reported that the gross capacity of the plant is 225MW, with two gas turbines from GE France and a steam turbine from Siemens Sweden. General Electric is the O&M operator of the plant. SPWL is awaiting revised tariff approval from NEPRA, following which discussions will commence with authorities. SPWL is willing to participate in the CTBCM model.

However, SPWL prefers direct transactions with bulk power consumers rather than contributing solely through CPPA-G. In 2024, the Company, GoP, CPPA-G, the Energy Task Force, and other 2002 Power Policy IPPs agreed to amend contractual terms. Key changes included: Return on Equity to be paid on a hybrid Take-and-Pay basis; revised O&M and working capital tariffs; updated O&M indexation; and capping of the insurance premium at 0.9% of EPC cost. The GoP withdrew arbitration claims, and the Company waived PKR 1.36 billion in late payment interest verified till October 31, 2024, which was charged to profit and loss. In return, the GoP committed to clear all verified outstanding receivables and facilitate the waiver of SNGPL’s late payment claims, failing which CPPA-G would pay.

Post year-end, the amendment was executed, and PKR 5.2 billion in receivables were received, though NEPRA’s tariff notification is awaited. As of December 31, 2024, total receivables stood at Rs. 8.2 billion, including the waived Rs. 1.36 billion. Management reported that receivables have started to accumulate again, currently ranging between PKR 2–2.5 billion. While recent government initiatives to resolve circular debt may lead to clearance for SPWL, the timing remains uncertain.

Saif Cement Limited completed its asset sale and distributed proceeds to shareholders, except PKR 7.9 million pending tax refund under adjudication, to be recognized upon receipt.

The Board declared no final dividend for 2024. Total dividend for the year was 12.5% (Rs. 1.25/share), down from 42.9% (Rs. 4.29/share) last year, paid from CPPA/GoP capacity payments. Going forward, management anticipates circular debt to remain a key challenge for the government and energy sector, especially with rising fuel prices, unless structural reforms are implemented.

However, power demand is expected to recover in CY25 as inflation and interest rates decline. Capacity utilization is expected to remain under pressure due to the shift toward renewables, economic slowdown, and weather conditions, though the plant maintained 100% reliability and 94% availability in CY24. Any excess surplus cash will be distributed to shareholders, as per management

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.