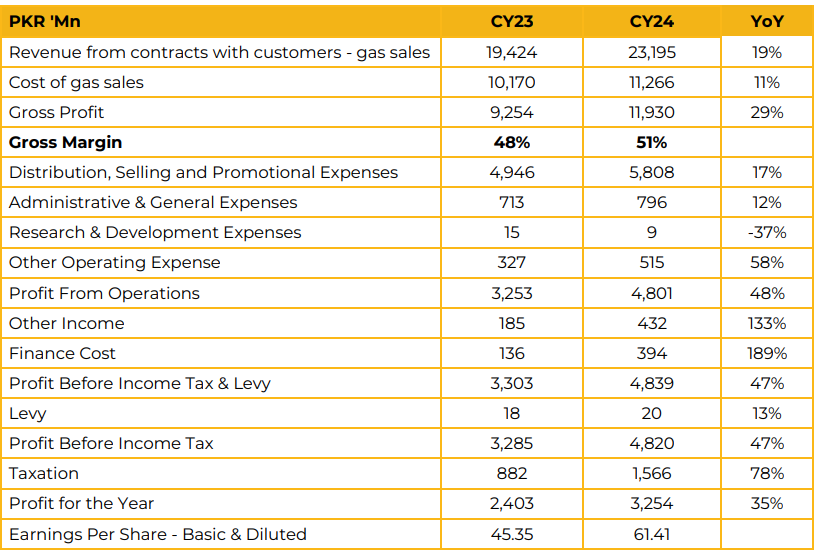

Highnoon Laboratories Limited (HINOON) reported a net profit of PKR 3.25 billion (EPS: PKR 61.41) in CY24, reflecting a 35% year-on-year increase from PKR 2.40 billion (EPS: PKR 45.35) in CY23. The sales revenue stood at PKR 23.30 billion compared to PKR 19.42 billion in the same period last year.

Management attributed this topline expansion to both price adjustments and volumetric growth. Group net revenue for the year reached PKR 24.63 billion. During CY24, the company launched 17 new products—11 in the chronic healthcare segment and six in acute care— contributing to the overall growth. The gross profit margin improved to 51% in CY24, up from 48% in the previous year.

Management stated that discounts of 10–20% were provided on acute products sold to public institutions and hospitals. Highnoon has outperformed the pharmaceutical industry by a factor of four and continues to maintain a healthy free float. The company’s export contribution increased to 7% of total sales in CY24 from 5% last year, with a continued upward trend expected. In 2024, the company received the Pharma PESA award. The total pharmaceutical industry crossed PKR 1 trillion in value, posting a 10-year CAGR of 10%, while Highnoon’s gross revenue reached PKR 26.52 billion, reflecting a much higher 10-year CAGR of 23%. Counting units for the industry stood at 211 billion (3-year CAGR: 2.9%), while Highnoon’s units reached 3,114 million (3-year CAGR: 7.3%).

Strategically, the company is focused on driving growth in the acute care segment, strengthening its position in primary care, and expanding its international footprint. The portfolio mix currently consists of 47% chronic care and 53% acute care. Key revenue-contributing brands include Cyrocin (PKR 1.9 billion), Combivair (PKR 1.8 billion), Tagipmet (PKR 1.5 billion), Kestine (PKR 1.3 billion), and the Forge Family (PKR 1.3 billion). Management disclosed that the top ten brands account for over 50% of the company’s gross revenue.

The high margins in the standalone financials are attributed to lower marketing expenses in specific therapeutic areas. The trade portfolio contributed 5% to the topline.

Management clarified that the recent restrictions on trade have had minimal impact on raw material procurement, as only 10% of raw materials are sourced from India, while 90% are imported from Europe and China.

They also stated that raw material prices have softened due to the ongoing ChinaU.S. trade tensions, which has created a favorable cost environment for local pharmaceutical manufacturers. Furthermore, the government has announced a subsidy on customs duties in the latest budget, which is expected to further support margin expansion.

Looking ahead, Highnoon plans to expand its presence in the acute and anti-infective therapeutic segments. The company targets a 10% increase in exports this year and aims for a 20% export contribution over the next five years. It is also working towards achieving an optimal mix of essential and non-essential products.

While no bonus issue is currently under consideration, the possibility of a stock split will be discussed in the upcoming board meeting. Management expects margins to remain stable, assuming currency fluctuations are contained. The company’s new manufacturing facility at Quaid-e-Azam Business Park is expected to be completed in the second half of CY25.

Sales growth is projected to range between 20% and 30% in CY25, supported by new product launches over the next two to three years. The company also has biologics products in the pipeline, which will be announced in due course.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.