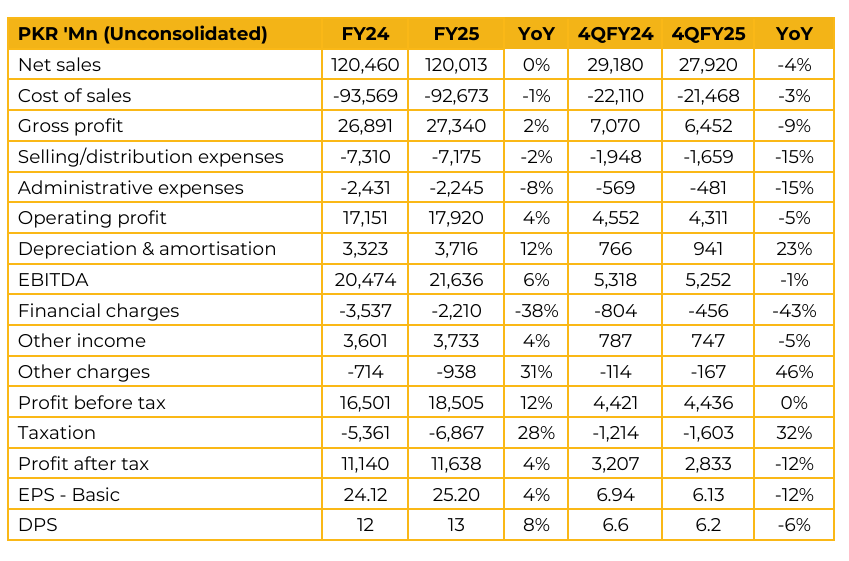

Lucky Core Industries Limited recorded earnings per share of PKR 25.20 in FY25, as compared to earning per share of PKR 24.12 in FY24. In 4QFY25, the company reported an earnings per share of PKR 6.13, as compared to earnings per share of PKR 6.94 in 4QFY24.

During the year, the company invested 5 billion in capex toward acquiring specific products and portfolios from Pfizer. In the soda ash segment, they also installed a new coal-fired boiler and expanded their dense ash production capacity by 70 KTPA. Export sales in the soda ash business declined by 74,000 tons compared to the SPLY due to intense market competition.

A significant operational milestone was the successful commissioning of an alternative energy boiler in June 2025 at the Khewra plant. This new boiler is designed to operate on multiple fuel sources, with local coal usage starting in July and biomass integration beginning in October. The segment faced challenges from a construction slowdown, which limited capacity utilization to 80%. Additionally, the business was impacted by tariffs and geopolitical conditions that led to increased inventory levels in China. The demand outlook for the first half of the year remains weak, with no major improvements in capacity utilization anticipated.

Despite these headwinds, the company is actively working to reduce energy costs and has a 200 KTPA expansion project in the design phase. The polyester segment is experiencing volume pressure from cheaper imported goods. The current energy mix for this business consists of 48% gas, 48% furnace oil, and 4% solar. The company plans to increase its solar energy capacity going forward.

The company has successfully integrated select assets acquired from Pfizer. The newly assimilated portfolio generated an operating profit of PKR 1.48 billion over a 10-month period. This segment maintains strong gross margins of 38%, with its portfolio comprised of 65% non-essential drugs and 35% essential drugs.

The Agri business continues to face significant headwinds due to erratic weather patterns, liquidity constraints, and evolving cropping preferences among farmers. In the animal health segment, the company’s strategy is focused on cost optimization and developing high-margin products. Construction of a new, Greenfield Veterinary Medicine Manufacturing unit is currently underway, with completion expected by the fourth quarter of 2026.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.