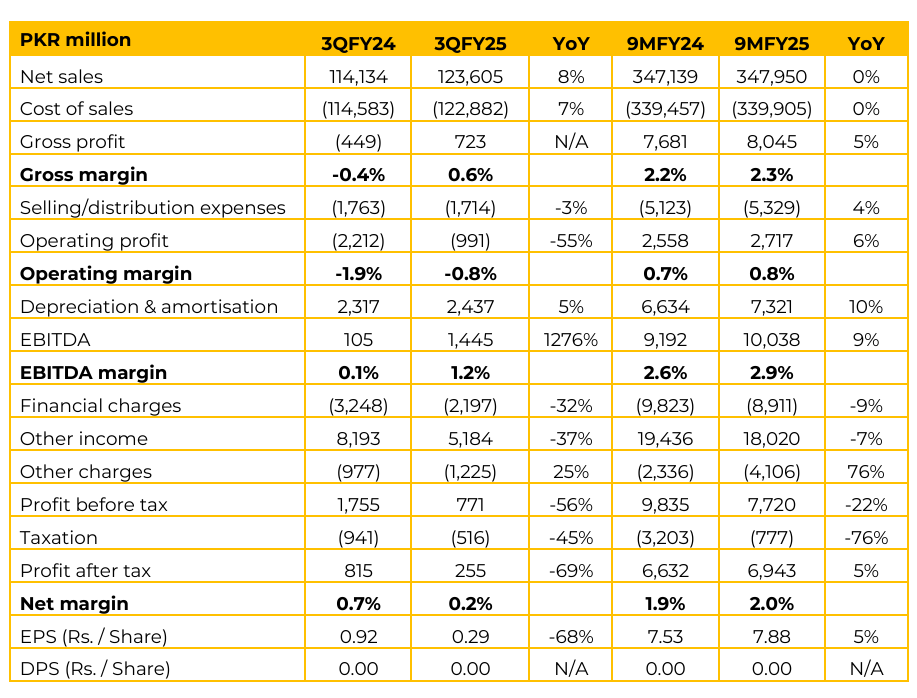

SSGC reported profit after tax of PKR 6.9 billion in 9MFY25 (EPS: PKR 7.88) compared to PKR 6.6 billion (EPS: PKR 7.53) in SPLY. Company’s current sales mix comprises of 49.2% to domestic, 19.5% to process industries, 15.4% to captive power, 11.2% to fertilizer, 3.1% to power generation and remaining to others. SSGC has made visible progress in reducing UFG, bringing it down from 16.6% in FY23 to 10.6% in FY24, saving ~41 BCF of gas since the rehabilitation program began. However, during 9MFY25, the UFG remained slightly higher at 12.86%, mainly due to the seasonal effect of 3rd Quarter.

Rehabilitation expanded significantly, with 1,500 km completed in FY24 and a plan for 2,500 km per year in FY25–26 and FY26–27. Key urban and rural areas of Sindh and Baluchistan have undergone rehabilitation, with theft control operations targeting large-scale unauthorized connections. Receivables from K-Electric and Pakistan Steel Mills remain a key drag on liquidity. KE mediation concluded without resolution, with the matter escalated to the SIFC committee. Gas supply to PSML has been discontinued, though legal proceedings continue.

The government’s circular debt resolution framework, supported by World Bank and KPMG, aims to prevent further accumulation. Meanwhile, SSGC’s subsidiaries have also contributed meaningfully. SSGC LPG Limited posted 246% revenue growth and a 67% increase in profitability, generating PKR 1.5 billion PAT in FY24.

The SSGC Meter Plant produced over one million meters last year, with localization reaching 97% and profits partially contributing to SSGC’s bottom line. SSGC Alternate Energy has begun diversifying into renewable areas such as biomethane, hydrogen, and waste-to-energy projects, while the dormant JJVL project is expected to resume operations shortly, with half of its profits accruing as non operating income to SSGC. The moratorium on new connections imposed in December 2021 has also been a hurdle, particularly in Karachi. Management expects it to be lifted soon within 15-30 days, with RLNG priced connections likely to resume within the next month.

Looking ahead, the company concluded capex of PKR 37 billion in FY25 and plans to invest PKR 30–40 billion annually in FY26 and FY27 to expand its asset base. It expects to roll out 50,000 new RLNG-based domestic connections per year, priced at around PKR 3,000 per MMBTU without slab system. These connections will be blended into the existing network but billed separately under specific RLNG contracts. Management intends to maintain UFG at current levels for indigenous gas, while RLNG losses remain a pass through. The tariff regime remains linked to the asset base, with returns tied to the weighted average cost of capital. OGRA’s review of WACOG, last determined in 2018, will be a key factor for future earnings.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.